EU indices down this morning | TA focus on Zalando

INDICES

Yesterday, European stocks advanced further. The Stoxx Europe 600 jumped 1.61%, Germany's DAX jumped 2.01%, France's CAC 40 rose 2.11% and the U.K.'s FTSE 100 was up 1.39%.

EUROPE ADVANCE/DECLINE

92% of STOXX 600 constituents traded higher yesterday.

32% of the shares trade above their 20D MA vs 11% Monday (below the 20D moving average).

51% of the shares trade above their 200D MA vs 45% Monday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.47pts to 32.76, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Media

3mths relative low: Technology

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.64% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -17bps (below its 20D MA).

ECONOMIC DATA

EC 09:45: ECB Panetta speech

FR 09:50: Oct Markit Services PMI final, exp.: 47.5

FR 09:50: Oct Markit Composite PMI final, exp.: 48.5

GE 09:55: Oct Markit Composite PMI final, exp.: 54.7

GE 09:55: Oct Markit Services PMI final, exp.: 50.6

EC 10:00: Oct Markit Services PMI final, exp.: 48

EC 10:00: Oct Markit Composite PMI final, exp.: 50.4

UK 10:30: Oct Markit/CIPS UK Services PMI final, exp.: 56.1

UK 10:30: Oct Markit/CIPS Composite PMI final, exp.: 56.5

EC 11:00: Sep PPI MoM, exp.: 0.1%

EC 11:00: Sep PPI YoY, exp.: -2.5%

GE 11:40: 5-Year Bobl auction, exp.: -0.73%

EC 16:00: ECB Schnabel speech

MORNING TRADING

In Asian trading hours, U.S. election vote-count brought volatility to the market. EUR/USD retreated to 1.1645 and GBP/USD dropped to 1.2988. USD/JPY rebounded to 105.06. AUD/USD slid to 0.7106. This morning, official data showed that Australia's retail sales fell 1.1% on month in September (-1.5% expected and preliminary).

Spot gold dipped to $1,893 an ounce.

#UK - IRELAND#

Smurfit Kappa, a corrugated packaging company, posted a 3Q trading statement: "Smurfit Kappa Group has delivered a strong set of results for the first nine months with an EBITDA of E1,125 million and an EBITDA margin of 17.8%. Our third quarter EBITDA of E390 million was particularly pleasing, both from an operational and financial perspective, demonstrating, once again, the strength and resilience of the Group. (...) the Group expects to deliver EBITDA in the range of E1,460 million to E1,480 million for the full year 2020."

Marks & Spencer, a retailer, posted 1H adjusted loss before tax of 17 million pounds, compared with an adjusted profit before tax of 176 million pounds in the prior-year period, and revenue was down 15.8% on year to 4.09 billion pounds.

#GERMANY#

Vonovia, a real estate company, posted 9-month FFO per share grew 4.7% on year to 1.80 euros and adjusted EBITDA climbed 7.6% to 1.43 billion euros on rental in come of 1.71 billion euros, up 11.8%.

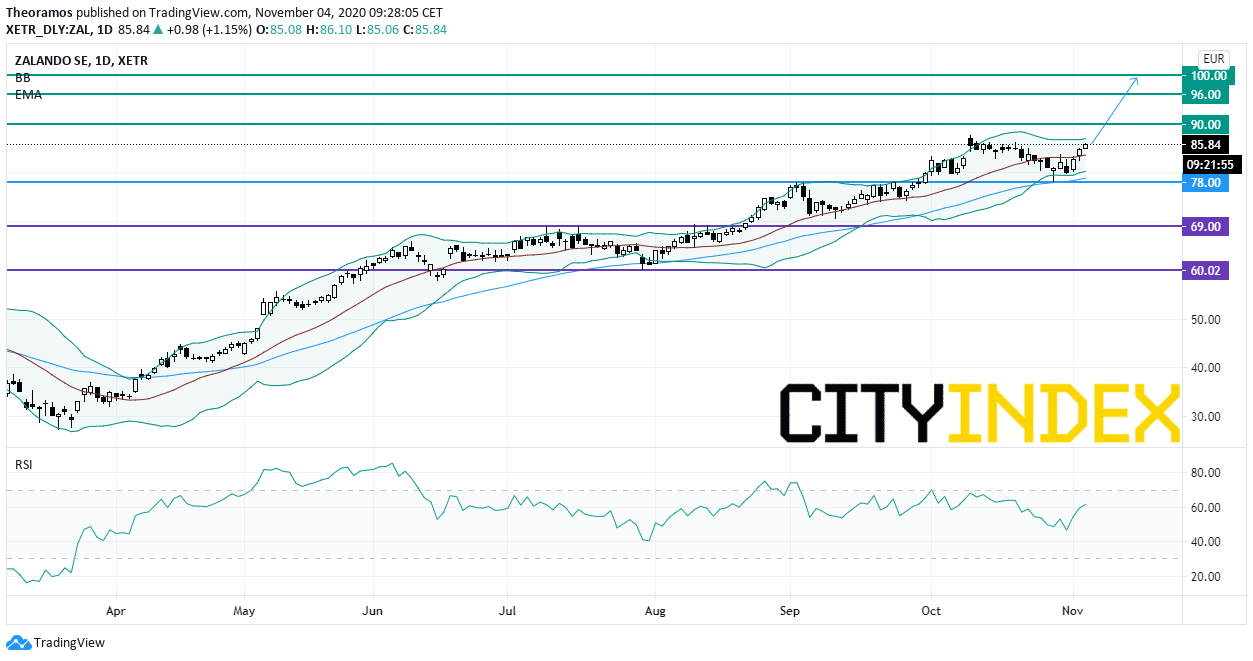

Zalando, an e-commerce company, reported that 9-month adjusted EBIT surged to 118 million euros from 6 million euros in the prior-year period on revenue of 1.85 billion euros, up 21.6%.

Yesterday, European stocks advanced further. The Stoxx Europe 600 jumped 1.61%, Germany's DAX jumped 2.01%, France's CAC 40 rose 2.11% and the U.K.'s FTSE 100 was up 1.39%.

EUROPE ADVANCE/DECLINE

92% of STOXX 600 constituents traded higher yesterday.

32% of the shares trade above their 20D MA vs 11% Monday (below the 20D moving average).

51% of the shares trade above their 200D MA vs 45% Monday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.47pts to 32.76, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Media

3mths relative low: Technology

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.64% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -17bps (below its 20D MA).

ECONOMIC DATA

EC 09:45: ECB Panetta speech

FR 09:50: Oct Markit Services PMI final, exp.: 47.5

FR 09:50: Oct Markit Composite PMI final, exp.: 48.5

GE 09:55: Oct Markit Composite PMI final, exp.: 54.7

GE 09:55: Oct Markit Services PMI final, exp.: 50.6

EC 10:00: Oct Markit Services PMI final, exp.: 48

EC 10:00: Oct Markit Composite PMI final, exp.: 50.4

UK 10:30: Oct Markit/CIPS UK Services PMI final, exp.: 56.1

UK 10:30: Oct Markit/CIPS Composite PMI final, exp.: 56.5

EC 11:00: Sep PPI MoM, exp.: 0.1%

EC 11:00: Sep PPI YoY, exp.: -2.5%

GE 11:40: 5-Year Bobl auction, exp.: -0.73%

EC 16:00: ECB Schnabel speech

MORNING TRADING

In Asian trading hours, U.S. election vote-count brought volatility to the market. EUR/USD retreated to 1.1645 and GBP/USD dropped to 1.2988. USD/JPY rebounded to 105.06. AUD/USD slid to 0.7106. This morning, official data showed that Australia's retail sales fell 1.1% on month in September (-1.5% expected and preliminary).

Spot gold dipped to $1,893 an ounce.

#UK - IRELAND#

Smurfit Kappa, a corrugated packaging company, posted a 3Q trading statement: "Smurfit Kappa Group has delivered a strong set of results for the first nine months with an EBITDA of E1,125 million and an EBITDA margin of 17.8%. Our third quarter EBITDA of E390 million was particularly pleasing, both from an operational and financial perspective, demonstrating, once again, the strength and resilience of the Group. (...) the Group expects to deliver EBITDA in the range of E1,460 million to E1,480 million for the full year 2020."

Marks & Spencer, a retailer, posted 1H adjusted loss before tax of 17 million pounds, compared with an adjusted profit before tax of 176 million pounds in the prior-year period, and revenue was down 15.8% on year to 4.09 billion pounds.

#GERMANY#

Vonovia, a real estate company, posted 9-month FFO per share grew 4.7% on year to 1.80 euros and adjusted EBITDA climbed 7.6% to 1.43 billion euros on rental in come of 1.71 billion euros, up 11.8%.

Zalando, an e-commerce company, reported that 9-month adjusted EBIT surged to 118 million euros from 6 million euros in the prior-year period on revenue of 1.85 billion euros, up 21.6%.

From a technical point of view, the stock remains supported by its rising 50-period exponential moving average. Above the key overlap area at 78E, a new up leg is expected after a recent consolidation phase towards 90E, 96E and 100E in extension.

#BENELUX#

Ahold Delhaize, a grocery retail company, reported that 3Q underlying EPS rose 12.3% on year to 0.50 euro on net sales of 17.83 billion euros, up 6.8% (+10.1% at constant exchange rates). The company raised its full-year underlying EPS guidance to the "high-20% range" from "low-to-mid-20% growth" previously and announced a new 1 billion euros share buyback program to be started at the beginning of 2021.

#SWITZERLAND#

Swiss Life, an insurance group, reported that 9-month net fee and commission income grew 6% on year (+10% in local currency) to 1.40 billion Swiss franc.

#DENMARK#

Danske Bank, a Danish bank, posted 3Q net income declined 29.4% on year to 1.99 billion Danish krone, as loan impairment charges jumped to 1.03 billion Danish krone from 0.29 billion Danish krone in the prior-year quarter. Meanwhile, net interest income grew 1.9% to 6.97 billion Danish krone.

EX-DIVIDEND

Julius Baer: SF0.375

Source: TradingView, GAIN Capital

#FRANCE#

#BENELUX#

Ahold Delhaize, a grocery retail company, reported that 3Q underlying EPS rose 12.3% on year to 0.50 euro on net sales of 17.83 billion euros, up 6.8% (+10.1% at constant exchange rates). The company raised its full-year underlying EPS guidance to the "high-20% range" from "low-to-mid-20% growth" previously and announced a new 1 billion euros share buyback program to be started at the beginning of 2021.

#SWITZERLAND#

Swiss Life, an insurance group, reported that 9-month net fee and commission income grew 6% on year (+10% in local currency) to 1.40 billion Swiss franc.

#DENMARK#

Danske Bank, a Danish bank, posted 3Q net income declined 29.4% on year to 1.99 billion Danish krone, as loan impairment charges jumped to 1.03 billion Danish krone from 0.29 billion Danish krone in the prior-year quarter. Meanwhile, net interest income grew 1.9% to 6.97 billion Danish krone.

EX-DIVIDEND

Julius Baer: SF0.375

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM