US Futures consolidate - Watch TTWO, AIG, NIO

Later today, June Factory Orders (+5.0% on month expected) and Durable Goods Orders (June final reading +7.3% on month expected) will be reported.

European indices are under pressure. The Eurozone's June Producer Price Index was reported at +0.7% (vs +0.6% on month expected).

Asian indices closed well on the upside. This morning, Tokyo's July Core CPI growth was reported at +0.4% on year (+0.1% expected). Also, and as expected, Australia's central bank kept its key interest rate unchanged at 0.25%. Official data showed that Australia's June Retail Sales grew 2.7% on month (+2.4% expected) and Exports increased 3% (+4% expected).

WTI Crude Oil futures are on the downside. Later today, API would release the change of U.S. oil stockpile data for July 31 (vs -6.829M barrel previously).

Gold consolidates but remains firm close to all-time high as COVID-19 fears persist.

Gold fell 2.24 dollars (-0.11%) to 1974.74 dollars.

The US dollar consolidates on talks regarding new stimulus bill.

The dollar index is nearly flat at 93.55.

U.S. Equity Snapshot

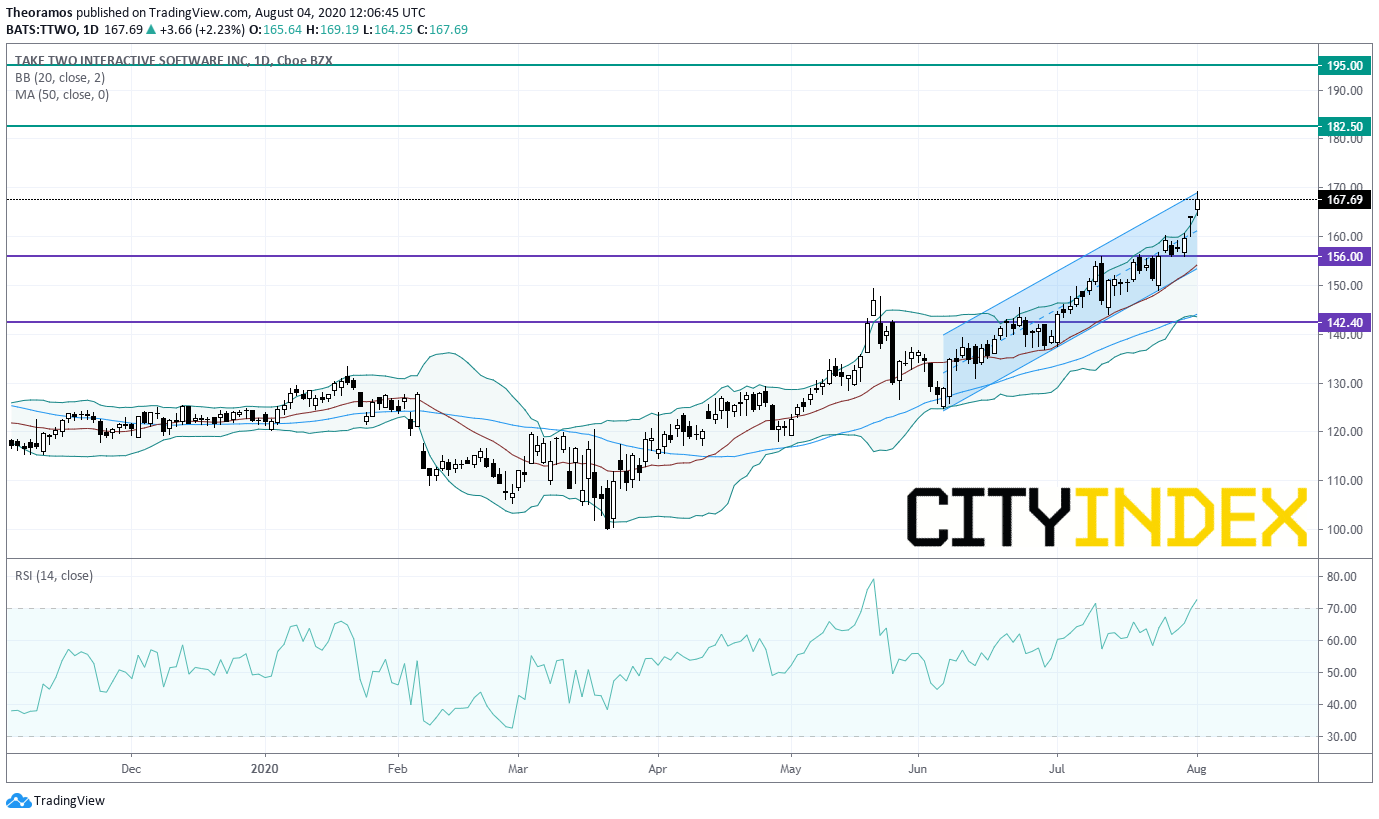

Take-Two Interactive Software Inc (TTWO), a leading global video game publisher, is expected to gain ground after hitting an all-time high yesterday as the company reported first quarter adjusted EPS of 2.30 dollars, above estimates, on revenue up to 831.3 million dollars compared to 422 million dollars a year ago. The Co raised its full-year outlook amid a demand surge for gaming during the coronavirus pandemic.

Source: TradingView, Gain Capital

AIG (AIG), a global insurance and financial services firm, reported second quarter loss of 7.94 billion dollars, or 9.15 dollars a share, from a profit of 1.1 billion dollars, or 1.24 dollar a share a year earlier. On an adjusted basis, EPS was 0.66 dollar, better than expected, vs 1.43 dollar a year ago.

Nio (NIO), the electric-vehicle marker, is climbing before hours as July car deliveries jumped 322%.