EU indices still mixed | TA focus on Engie

INDICES

Yesterday, European stocks were mixed. The Stoxx Europe 50 fell 0.1%, Germany's DAX dropped 0.5% and France's CAC 40 was little changed, while the U.K.'s FTSE 100 surged 1.2%.

EUROPE ADVANCE/DECLINE

56% of STOXX 600 constituents traded lower or unchanged yesterday.

66% of the shares trade above their 20D MA vs 71% Tuesday (below the 20D moving average).

84% of the shares trade above their 200D MA vs 85% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.39pt to 21.69, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Financial Services, Banks, Basic Resource

3mths relative low: Food & Beverage

Europe Best 3 sectors

basic resources, banks, energy

Europe worst 3 sectors

chemicals, retail, travel & leisure

INTEREST RATE

The 10yr Bund yield rose 4bps to -0.53% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -20bps (below its 20D MA).

ECONOMIC DATA

EC 09:00: ECB General Council Meeting

FR 09:50: Nov Markit Services PMI final, exp.: 46.5

FR 09:50: Nov Markit Composite PMI final, exp.: 47.5

GE 09:55: Nov Markit Services PMI final, exp.: 49.5

GE 09:55: Nov Markit Composite PMI final, exp.: 55

EC 10:00: Nov Markit Composite PMI final, exp.: 50

EC 10:00: Nov Markit Services PMI final, exp.: 46.9

UK 10:30: Nov Markit/CIPS UK Services PMI final, exp.: 51.4

UK 10:30: Nov Markit/CIPS Composite PMI final, exp.: 52.1

EC 11:00: Oct Retail Sales MoM, exp.: -2%

EC 11:00: Oct Retail Sales YoY, exp.: 2.2%

FR 11:00: 3-Year BTAN auction, exp.: -0.71%

FR 11:00: 5-Year BTAN auction, exp.: -0.62%

FR 11:00: 10-Year OAT auction, exp.: -0.38%

FR 11:00: Oct Retail Sales MoM, exp.: -4.5%

FR 11:00: Oct Retail Sales YoY, exp.: 2.7%

MORNING TRADING

In Asian trading hours, EUR/USD was firm at 1.2118 and GBP/USD edged up to 1.3376. USD/JPY was little changed at 104.46. AUD/USD eased to 0.7411. Earlier today, official data showed that Australia's trade surplus totaled 7.46 billion Australian dollars in October (5.80 billion Australian dollars expected).

Spot gold slipped to $1,829 an ounce.

#UK - IRELAND#

Sainsbury, a chain of supermarkets, said it has chosen to forgo the business rates relief on Sainsbury's stores granted by the UK Government and the Devolved Administrations since March. The company stated: "Including business rates payments within underlying profit before tax1 (UPBT), we now expect UPBT of at least £270 million for the financial year to March 2021. This includes the assumption that we will now forgo approximately £410 million of business rates relief."

Phoenix Group, an insurance services provider, posted a trading update: "£1,713 million of cash generation1 in 2020 (2019: £707 million) exceeding the upper end of the 2020 cash generation target range of £1.5 billion - £1.6 billion. (...) Solvency II surplus increased by £0.6 billion to £5.0 billion2 as at 30 September 2020 from £4.4 billion3 at 30 June 2020 on a pro-forma basis."

#GERMANY#

Henkel, a chemical and consumer goods company, was upgraded to "overweight" from "neutral" at JPMorgan.

#FRANCE#

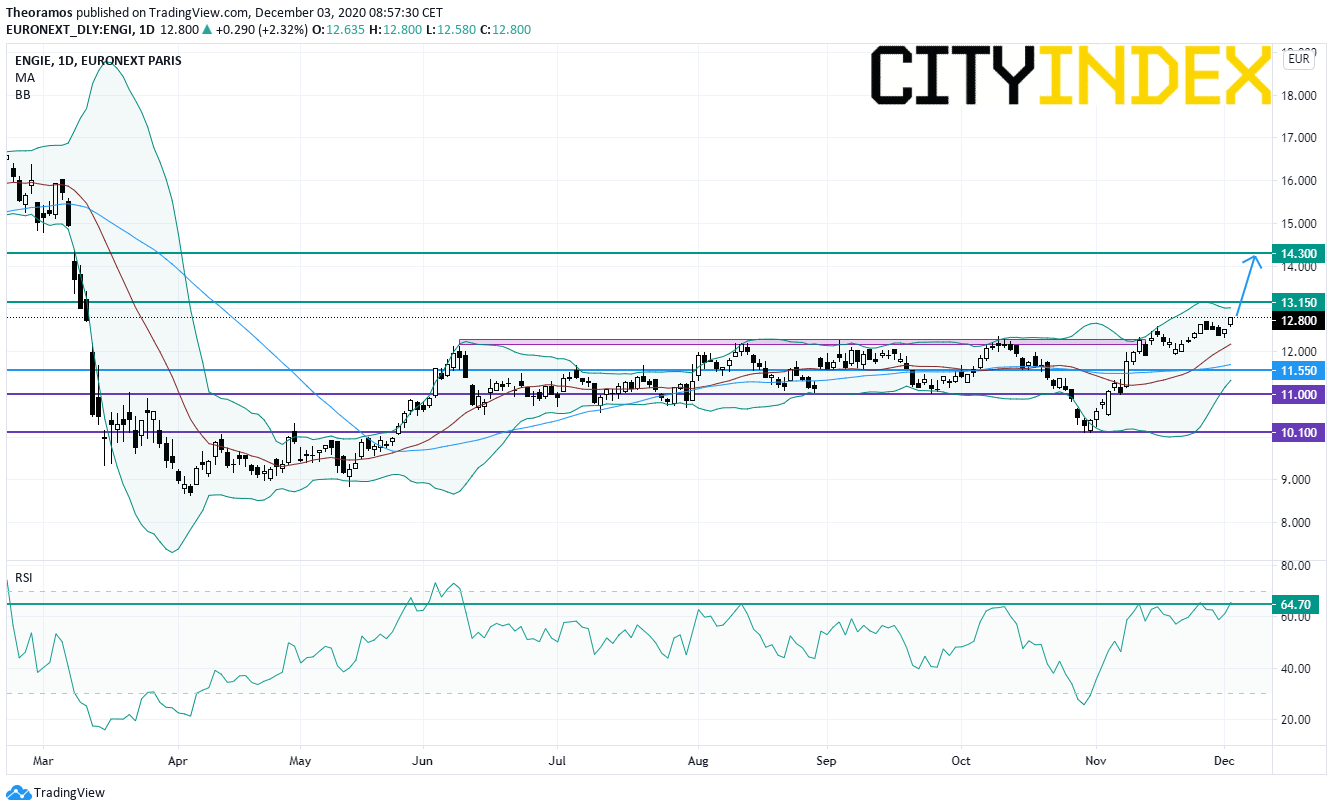

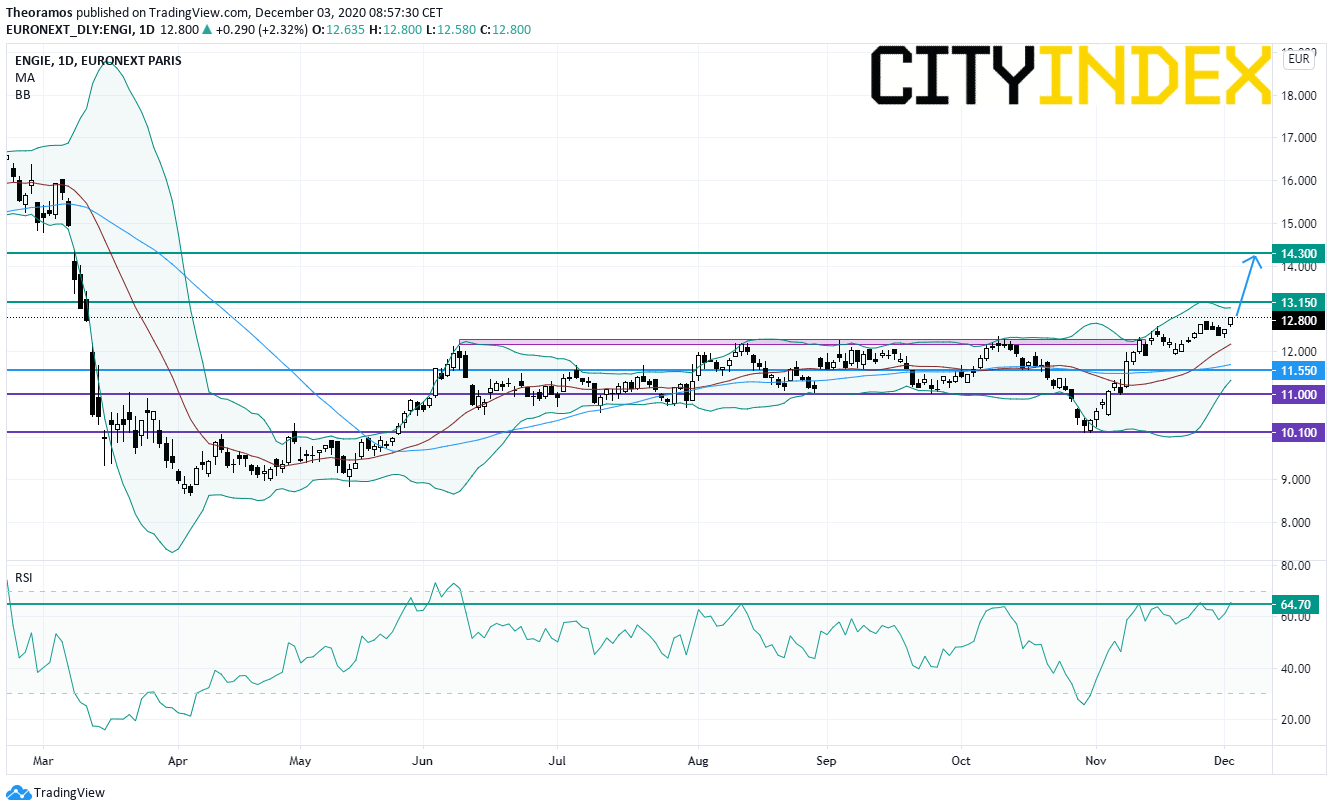

Engie, an electric utility company, is planning to sell some of its services businesses for about 5 billion euros, reported Bloomberg citing people familiar with the matter.

From a technical point of view, the stock has broken the former horizontal key resistance around 12.2E, which contained the share price since June 2020. Furthermore, on the RSI, a break of the key level at 65% could confirm the continuation of the bullish mood. Above 11.55E, look towards 13.15E and 14.3E in extension.

Danone, a food company, was downgraded to "neutral" from "overweight" at JPMorgan.

#SWITZERLAND#

SGS, a testing and certification services provider, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

EX-DIVIDEND

3I Group:17.5p, Credit Suisse: SF0.0694, Telia: SEK0.65

Yesterday, European stocks were mixed. The Stoxx Europe 50 fell 0.1%, Germany's DAX dropped 0.5% and France's CAC 40 was little changed, while the U.K.'s FTSE 100 surged 1.2%.

EUROPE ADVANCE/DECLINE

56% of STOXX 600 constituents traded lower or unchanged yesterday.

66% of the shares trade above their 20D MA vs 71% Tuesday (below the 20D moving average).

84% of the shares trade above their 200D MA vs 85% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.39pt to 21.69, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Financial Services, Banks, Basic Resource

3mths relative low: Food & Beverage

Europe Best 3 sectors

basic resources, banks, energy

Europe worst 3 sectors

chemicals, retail, travel & leisure

INTEREST RATE

The 10yr Bund yield rose 4bps to -0.53% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -20bps (below its 20D MA).

ECONOMIC DATA

EC 09:00: ECB General Council Meeting

FR 09:50: Nov Markit Services PMI final, exp.: 46.5

FR 09:50: Nov Markit Composite PMI final, exp.: 47.5

GE 09:55: Nov Markit Services PMI final, exp.: 49.5

GE 09:55: Nov Markit Composite PMI final, exp.: 55

EC 10:00: Nov Markit Composite PMI final, exp.: 50

EC 10:00: Nov Markit Services PMI final, exp.: 46.9

UK 10:30: Nov Markit/CIPS UK Services PMI final, exp.: 51.4

UK 10:30: Nov Markit/CIPS Composite PMI final, exp.: 52.1

EC 11:00: Oct Retail Sales MoM, exp.: -2%

EC 11:00: Oct Retail Sales YoY, exp.: 2.2%

FR 11:00: 3-Year BTAN auction, exp.: -0.71%

FR 11:00: 5-Year BTAN auction, exp.: -0.62%

FR 11:00: 10-Year OAT auction, exp.: -0.38%

FR 11:00: Oct Retail Sales MoM, exp.: -4.5%

FR 11:00: Oct Retail Sales YoY, exp.: 2.7%

MORNING TRADING

In Asian trading hours, EUR/USD was firm at 1.2118 and GBP/USD edged up to 1.3376. USD/JPY was little changed at 104.46. AUD/USD eased to 0.7411. Earlier today, official data showed that Australia's trade surplus totaled 7.46 billion Australian dollars in October (5.80 billion Australian dollars expected).

Spot gold slipped to $1,829 an ounce.

#UK - IRELAND#

Sainsbury, a chain of supermarkets, said it has chosen to forgo the business rates relief on Sainsbury's stores granted by the UK Government and the Devolved Administrations since March. The company stated: "Including business rates payments within underlying profit before tax1 (UPBT), we now expect UPBT of at least £270 million for the financial year to March 2021. This includes the assumption that we will now forgo approximately £410 million of business rates relief."

Phoenix Group, an insurance services provider, posted a trading update: "£1,713 million of cash generation1 in 2020 (2019: £707 million) exceeding the upper end of the 2020 cash generation target range of £1.5 billion - £1.6 billion. (...) Solvency II surplus increased by £0.6 billion to £5.0 billion2 as at 30 September 2020 from £4.4 billion3 at 30 June 2020 on a pro-forma basis."

#GERMANY#

Henkel, a chemical and consumer goods company, was upgraded to "overweight" from "neutral" at JPMorgan.

#FRANCE#

Engie, an electric utility company, is planning to sell some of its services businesses for about 5 billion euros, reported Bloomberg citing people familiar with the matter.

From a technical point of view, the stock has broken the former horizontal key resistance around 12.2E, which contained the share price since June 2020. Furthermore, on the RSI, a break of the key level at 65% could confirm the continuation of the bullish mood. Above 11.55E, look towards 13.15E and 14.3E in extension.

Source: TradingView, GAIN Capital

Vivendi's, a media conglomerate, "BBB" credit rating outlook was revised to "Negative" from "Stable" by S&P Global Ratings. The rating agency said: "French media group Vivendi S.A. is contemplating the disposal of nearly half of Universal Music Group (UMG)-its largest earnings contributor and fastest-growing business--over the next 18 months. We see a risk that the group's business profile could weaken, if the proceeds are not reinvested in assets that are of equivalent quality and have similar growth prospects."Danone, a food company, was downgraded to "neutral" from "overweight" at JPMorgan.

#SWITZERLAND#

SGS, a testing and certification services provider, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

EX-DIVIDEND

3I Group:17.5p, Credit Suisse: SF0.0694, Telia: SEK0.65

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM