U.S Futures green ahead of Election Day - Watch PYPL, TWTR

The S&P 500 Futures are extending their rebound started on Monday, when the Dow Jones Industrial Average jumped 423 points (+1.60%) to 26925, the S&P 500 gained 40 points (+1.23%) to 3310, while the Nasdaq 100 only added 31 points (+0.29%) to 11084. On the single stock front, Twitter lost an additional 4.57% on Monday following a 21% slump last Friday.

Later today, the U.S. Commerce Department will report September factory order (+1.0% on month expected) but all eyes and minds will be on the U.S. election with first results due to start coming in this evening.

European indices are on the upside gaining between 1.5% and 2%.

Asian indices closed significantly higher with the Japanese markets being on holidays for the Cultural day. This morning, the Reserve Bank of Australia cut its benchmark rate to 0.10% from 0.25% as expected and announced a 100 billion Australian dollars bond purchase program of 5 to 10 years government bonds over the next six months. The central bank said it "is not expecting to increase the cash rate for at least three years" and "is prepared to do more if necessary".

WTI Crude Oil futures are extending their recovery helped by a global equity market rebound while OPEC+ might delay its January output increase for an extra three months, reported Bloomberg. JPMorgan lowered its 4Q average Brent forecast to $39/bbl from $41/bbl as renewed lockdowns in Europe further weigh on demand. Later today, American Petroleum Institute (API) will release the change of U.S. oil stockpile data for October 30.

US indices closed up on Monday, lifted by Energy (+3.67%), Materials (+3.39%) and Capital Goods (+3.23%) sectors.

On the US economic data front, Markit's US Manufacturing Purchasing Managers' Index slightly rose to 53.4 on month in the October final reading (53.3 expected), from 53.3 in the October preliminary reading. Finally, Construction Spending increased 0.3% on month in September (+1.0% expected), compared to +1.4% in August.

Gold gains ground on COVID-19 worries while the U.S dollar consolidates before U.S election.

Gold rose 5.54 dollars (+0.29%) to 1901.02 dollars.

The dollar index fell 0.54pt to 93.59.

U.S. Equity Snapshot

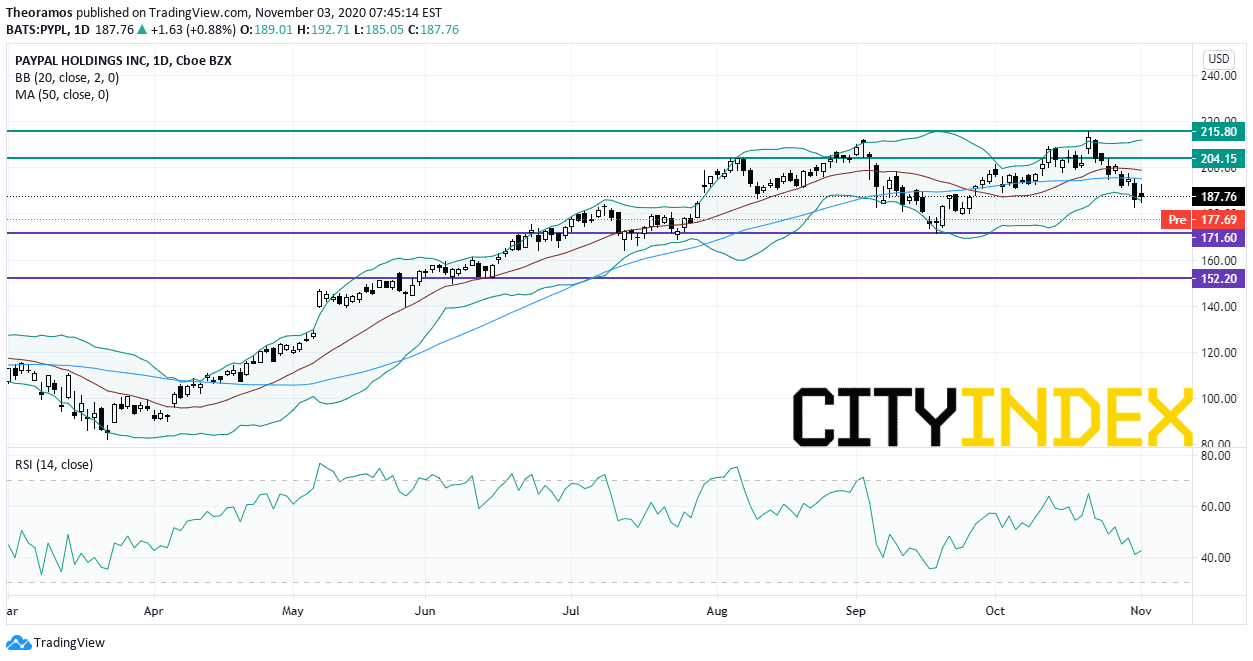

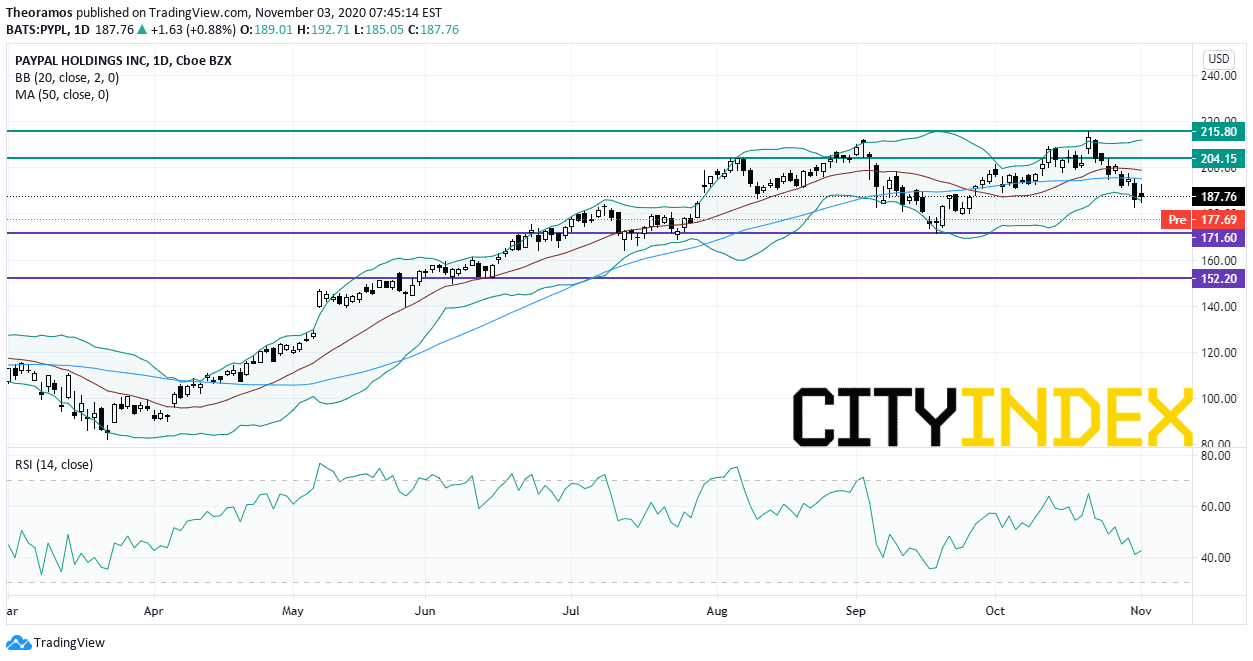

PayPal (PYPL), an online payment firm, slid postmarket after lowering its full year sales growth forecast to 21-22% at constant exchange rates from 22% previously expected. Also, third quarter net new active accounts were down to 15.2 million, missing estimates, from 21.3 million in the previous quarter.

Source: TradingView, GAIN Capital

Constellation Brands (STZ), the producer of branded alcoholic beverages, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

Mondelez International (MDLZ), a packaged food and beverage company, edged down after hours as third quarter adjusted EPS matched estimates.

Arista Networks (ANET), a designer and seller of high-speed networking solutions, soared in extended after announcing third quarter adjusted EPS of 2.42 dollars, beating estimates, down from 2.69 dollars a year ago, on revenue of 605.4 million dollars, higher than expected, down from 654.4 million dollars a year earlier.

Diamondback Energy (FANG), an independent oil and gas producer in the US, posted third quarter adjusted EPS of 0.62 dollar, exceeding the consensus, down from 1.47 dollar a year ago on revenue of 720.0 million dollars, better than expected, down from 967.0 million dollars a year earlier.

Skyworks Solutions (SWKS), a producer of wireless semiconductors, released fourth quarter adjusted EPS of 1.85 dollar, ahead the forecasts, up from 1.52 dollar a year ago on revenue of 956.8 million dollars, also above consensus, up from 827.4 million dollars a year earlier.

Later today, the U.S. Commerce Department will report September factory order (+1.0% on month expected) but all eyes and minds will be on the U.S. election with first results due to start coming in this evening.

European indices are on the upside gaining between 1.5% and 2%.

Asian indices closed significantly higher with the Japanese markets being on holidays for the Cultural day. This morning, the Reserve Bank of Australia cut its benchmark rate to 0.10% from 0.25% as expected and announced a 100 billion Australian dollars bond purchase program of 5 to 10 years government bonds over the next six months. The central bank said it "is not expecting to increase the cash rate for at least three years" and "is prepared to do more if necessary".

WTI Crude Oil futures are extending their recovery helped by a global equity market rebound while OPEC+ might delay its January output increase for an extra three months, reported Bloomberg. JPMorgan lowered its 4Q average Brent forecast to $39/bbl from $41/bbl as renewed lockdowns in Europe further weigh on demand. Later today, American Petroleum Institute (API) will release the change of U.S. oil stockpile data for October 30.

US indices closed up on Monday, lifted by Energy (+3.67%), Materials (+3.39%) and Capital Goods (+3.23%) sectors.

Approximately 60% of stocks in the S&P 500 Index were trading above their 200-day moving average and 15% were trading above their 20-day moving average. The VIX Index dropped 0.89pt (-2.34%) to 37.13 and WTI Crude Oil jumped $1.16 (+3.24%) to $36.95 at the close.

On the US economic data front, Markit's US Manufacturing Purchasing Managers' Index slightly rose to 53.4 on month in the October final reading (53.3 expected), from 53.3 in the October preliminary reading. Finally, Construction Spending increased 0.3% on month in September (+1.0% expected), compared to +1.4% in August.

Gold gains ground on COVID-19 worries while the U.S dollar consolidates before U.S election.

Gold rose 5.54 dollars (+0.29%) to 1901.02 dollars.

The dollar index fell 0.54pt to 93.59.

U.S. Equity Snapshot

PayPal (PYPL), an online payment firm, slid postmarket after lowering its full year sales growth forecast to 21-22% at constant exchange rates from 22% previously expected. Also, third quarter net new active accounts were down to 15.2 million, missing estimates, from 21.3 million in the previous quarter.

Source: TradingView, GAIN Capital

Twitter (TWTR): an independent committee "expressed its confidence in management and recommended that the current structure remain in place."

Ford Motor (F)'s, the automobile manufacturer, target price was upgraded to 9.5 dollars from 8.5 dollars at Jefferies.Constellation Brands (STZ), the producer of branded alcoholic beverages, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

Mondelez International (MDLZ), a packaged food and beverage company, edged down after hours as third quarter adjusted EPS matched estimates.

Arista Networks (ANET), a designer and seller of high-speed networking solutions, soared in extended after announcing third quarter adjusted EPS of 2.42 dollars, beating estimates, down from 2.69 dollars a year ago, on revenue of 605.4 million dollars, higher than expected, down from 654.4 million dollars a year earlier.

Diamondback Energy (FANG), an independent oil and gas producer in the US, posted third quarter adjusted EPS of 0.62 dollar, exceeding the consensus, down from 1.47 dollar a year ago on revenue of 720.0 million dollars, better than expected, down from 967.0 million dollars a year earlier.

Skyworks Solutions (SWKS), a producer of wireless semiconductors, released fourth quarter adjusted EPS of 1.85 dollar, ahead the forecasts, up from 1.52 dollar a year ago on revenue of 956.8 million dollars, also above consensus, up from 827.4 million dollars a year earlier.