US Futures slightly up - Watch MSFT, MPC, GOOGL, MRK, YUM

Futures remain on the upside after they closed higher on Friday. Apple (AAPL +10.47%) gapped up to close at an all-time high of $425.04 after reporting better-than-expected earnings.

Later today, July ISM Manufacturing Index (53.5 expected) and June Construction Spending (+1.0% on month expected) will be reported. Markit Manufacturing PMI will be expected at 51.3.

European indices are bullish. The July Markit Eurozone Manufacturing Purchasing Managers' Index was reported at 51.8, vs 51.1 expected. Also, Markit Manufacturing PMIs were released for Germany at 51.0 (vs 50.0 expected), for the U.K. at 53.3 (vs 53.6 expected), and for France at 52.4 (vs 52.0 expected).

Asian indices closed mixed. The Japanese Nikkei and the Chinese CSI were up when the Australian ASX and the Hong Kong HSI closed in the red. The Chinese July Caixin Manufacturing PMI was released at 52.8, better than 51.3 expected.

WTI Crude Oil futures are under pressure. The number of rigs in the U.S. was unchanged at 251 for week ended July 31, while the amount of rigs in Canada rose by 3 to 45, according to Baker Hughes.

Gold eases after hitting a new record high on COVID-19 fears.

Gold fell 3.87 dollars (-0.2%) to 1971.99 dollars.

The US dollar is rebounding after having posted its weakest month in a decade.

The dollar index rose 0.42pt to 93.766.

U.S. Equity Snapshot

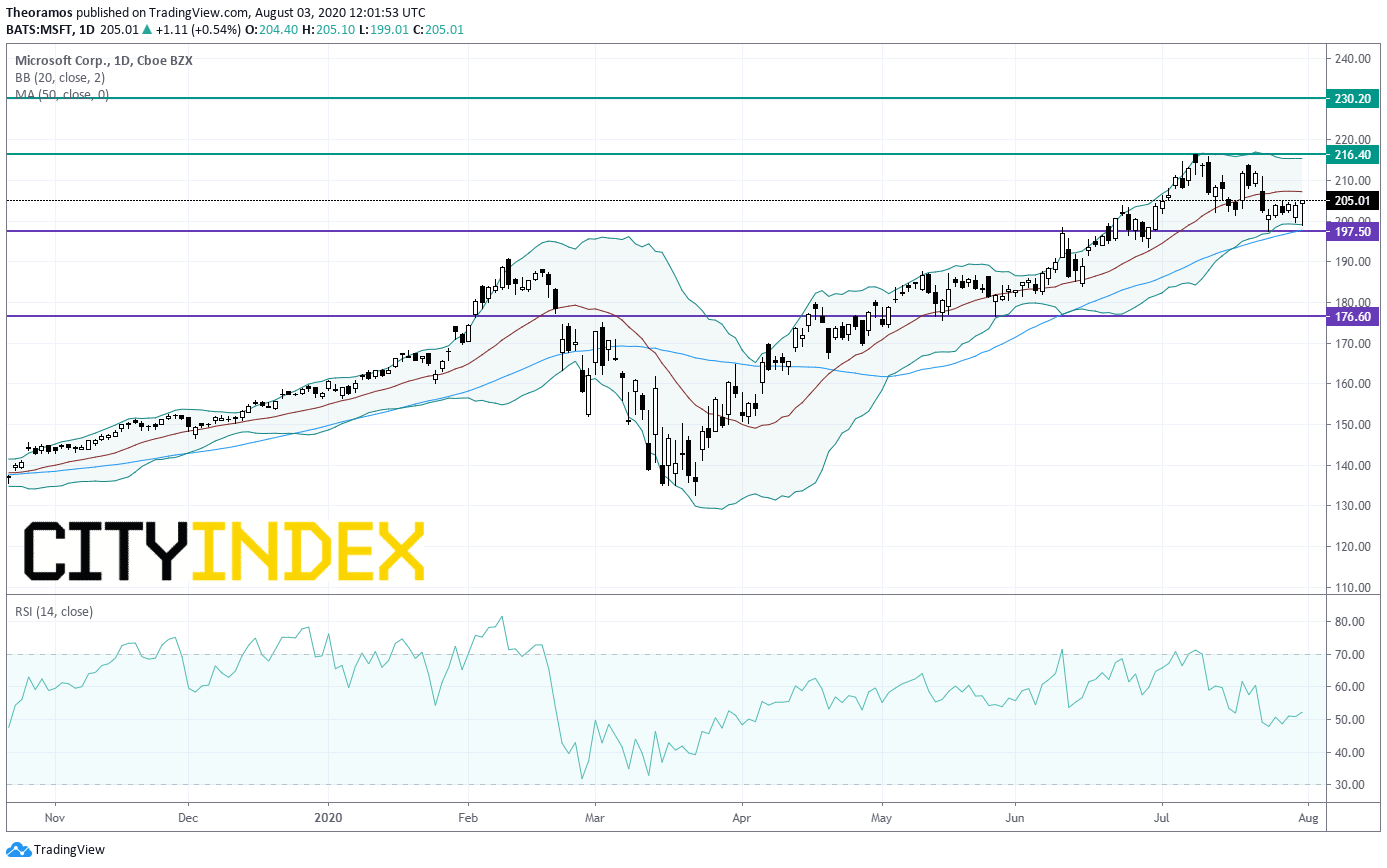

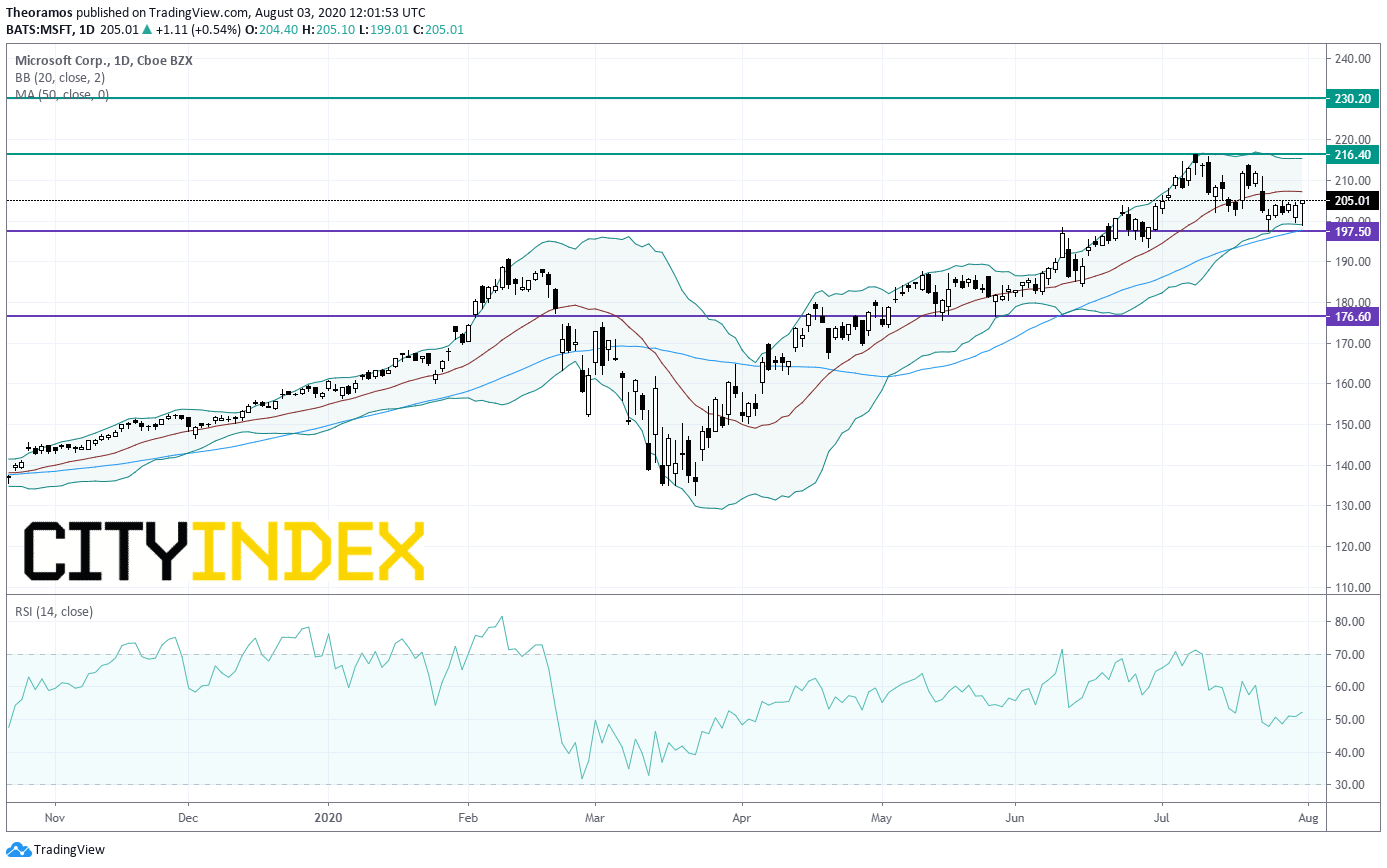

Microsoft (MSFT), the tech giant, confirmed talks to buy TikTok's US operations.

Alphabet (GOOGL): Google announced the acquisition of 6.6% of home and business security company ADT (ADT) for 450 million dollars.

Merck (MRK), the pharma giant, was upgraded to "buy" from "neutral" at Goldman Sachs.

Yum! Brands (YUM), owner of a range of quick-service restaurants, was upgraded to "buy" from "neutral" at Deutsche Bank.

Clorox Company (CLX), a producer of cleaning supplies and other consumer products, is gaining ground before hours after posting quarterly earnings that beat estimates and named a new CEO.

Later today, July ISM Manufacturing Index (53.5 expected) and June Construction Spending (+1.0% on month expected) will be reported. Markit Manufacturing PMI will be expected at 51.3.

European indices are bullish. The July Markit Eurozone Manufacturing Purchasing Managers' Index was reported at 51.8, vs 51.1 expected. Also, Markit Manufacturing PMIs were released for Germany at 51.0 (vs 50.0 expected), for the U.K. at 53.3 (vs 53.6 expected), and for France at 52.4 (vs 52.0 expected).

Asian indices closed mixed. The Japanese Nikkei and the Chinese CSI were up when the Australian ASX and the Hong Kong HSI closed in the red. The Chinese July Caixin Manufacturing PMI was released at 52.8, better than 51.3 expected.

WTI Crude Oil futures are under pressure. The number of rigs in the U.S. was unchanged at 251 for week ended July 31, while the amount of rigs in Canada rose by 3 to 45, according to Baker Hughes.

Gold eases after hitting a new record high on COVID-19 fears.

Gold fell 3.87 dollars (-0.2%) to 1971.99 dollars.

The US dollar is rebounding after having posted its weakest month in a decade.

The dollar index rose 0.42pt to 93.766.

U.S. Equity Snapshot

Microsoft (MSFT), the tech giant, confirmed talks to buy TikTok's US operations.

Source: TradingView, Gain Capital

Marathon Petroleum (MPC), a crude oil refining company, announced the sale of its Speedway gas stations in the U.S. to Japan's Seven & i Holdings for 21 billion dollars.Alphabet (GOOGL): Google announced the acquisition of 6.6% of home and business security company ADT (ADT) for 450 million dollars.

Merck (MRK), the pharma giant, was upgraded to "buy" from "neutral" at Goldman Sachs.

Yum! Brands (YUM), owner of a range of quick-service restaurants, was upgraded to "buy" from "neutral" at Deutsche Bank.

Clorox Company (CLX), a producer of cleaning supplies and other consumer products, is gaining ground before hours after posting quarterly earnings that beat estimates and named a new CEO.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM