US Futures rising, watch WU, MGI, SBUX, DCI, CBOE

No major economic data are due today in the US.

European indices are pushing higher. Germany Dax 30 reopened after the long Pentecost weekend. Trade talks between the European Union and the U.K. will resume later today. In the U.K., the Nationwide Building Society has published its house price index for May at -1.7% (vs -1.0% on month expected). The Bank of England has released the number of mortgage approvals in April at 15,800 (vs 24,000 expected). April French budget balance was released at -92.1 billion euros, vs -68 billion expected.

Asian indices all closed in the green. The Reserve Bank of Australia held its benchmark rate unchanged at 0.25%, as expected.

WTI Crude Oil Futures remain well directed. Later today, API would release the change of U.S. oil stockpile data for May 29.

Gold remains firm on US-China tensions and civil unrest in the US. The US dollar is still losing ground on economic recovery hopes. The euro hit a 11-week high on rallying equities.

Gold rose 0.74$ (+0.04%) to 1740.3 dollars. The EUR/USD rose 30pips to 1.1166 while GBP/USD gained 51pips to 1.2543.

US Equity Snapshot

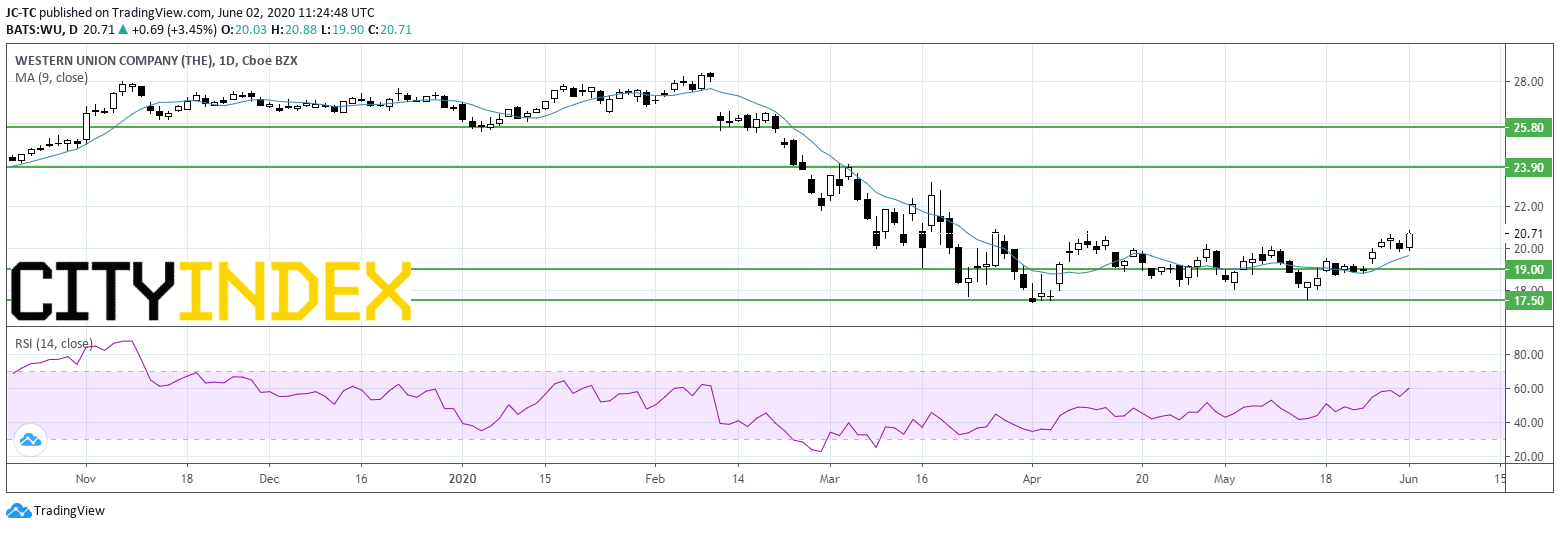

Western Union (WU), a global money transfer company, jumped in extended trading after Bloomberg reported the company might have bid for money transfers specialist MoneyGram International (MGI).

Starbucks (SBUX), the global specialty coffee chain, may furthermore reduce US employees hours to meet weak demand, according to the Wall Street Journal.

Donaldson (DCI), a global leader in the filtration industry, reported third quarter adjusted EPS down to 0.50 dollar from 0.58 dollar a year earlier, on sales down 12% to 629.7 million dollars. The company expects May sales to decrease about 24%.

CBOE Global Markets (CBOE), an operator of financial exchange platforms worldwide, was downgraded to "neutral" from "overweight" at JPMorgan.

Source : TradingVIEW, Gain Capital