EU indices under pressure | TA focus on Porsche

INDICES

Yesterday, European stocks closed mixed. The Stoxx Europe 600 Index rose 0.20%, France's CAC 40 climbed 0.43% and the U.K.'s FTSE 100 was up 0.23%, while Germany's DAX 30 fell 0.23%,

EUROPE ADVANCE/DECLINE

60% of STOXX 600 constituents traded higher yesterday.

48% of the shares trade above their 20D MA vs 42% Wednesday (below the 20D moving average).

56% of the shares trade above their 200D MA vs 55% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.48pt to 26.54, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Pers. & House. Goods

3mths relative low: Telecom., Insurance, Energy

Europe Best 3 sectors

utilities, technology, industrial goods & services

Europe worst 3 sectors

banks, energy, insurance

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.52% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -17bps (above its 20D MA).

ECONOMIC DATA

FR 07:45: Aug Budget Balance, exp.: E-151.04B

GE 09:00: Bundesbank Wuermeling speech

EC 10:00: Sep Core Inflation Rate YoY Flash, exp.: 0.4%

EC 10:00: Sep Inflation Rate YoY Flash, exp.: -0.2%

EC 10:00: Sep Inflation Rate MoM Flash, exp.: -0.4%

EC 11:00: ECB Guindos speech

MORNING TRADING

Both China and Hong Kong markets remained closed for a holiday. In Japan, the Tokyo Stock Exchange resumed stock trading which was halted for a whole day yesterday due to a technical glitch. The U.S. dollar bounced in Asian trading hours, as the ICE Dollar Index pushed above 93.90. House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin failed again to reach an agreement on a coronavirus stimulus package. Meanwhile, the House passed a 2.2-trillion-dollar Democratic coronavirus stimulus plan, which is unlikely to pass through the Republican-held Senate. EUR/USD dropped to 1.1715 and GBP/USD fell to 1.2860. USD/JPY rebounded to levels above 105.60. AUD/USD showed downward momentum testing the support at 0.7150. Official data showed that Australia's Retail Sales dropped 4.0% in August (-4.2% expected, -3.2% in July).

Spot gold declined to $1,890 an ounce.

U.S. President Donald Trump has announced he was tested positive for Covid-19.

#UK - IRELAND#

Ryanair, a budget airline, tweeted: "If the Irish Government does not fully adopt the EU travel regulations permitting unrestricted air travel to/from those regions of Europe that are Green or Amber from 13 Oct, then regrettably the Cork and Shannon bases will close on 26 Oct."

#GERMANY#

BMW, a German car maker, reported that its group U.S. sales dropped 8.7% on year in the third quarter.

Volkswagen, a German car maker, posted 3Q U.S. sales decline of 7.6% on year.

Porsche, a luxury car brand, said it sold 15,548 vehicles in the U.S. in the third quarter, up 5.0% on year.

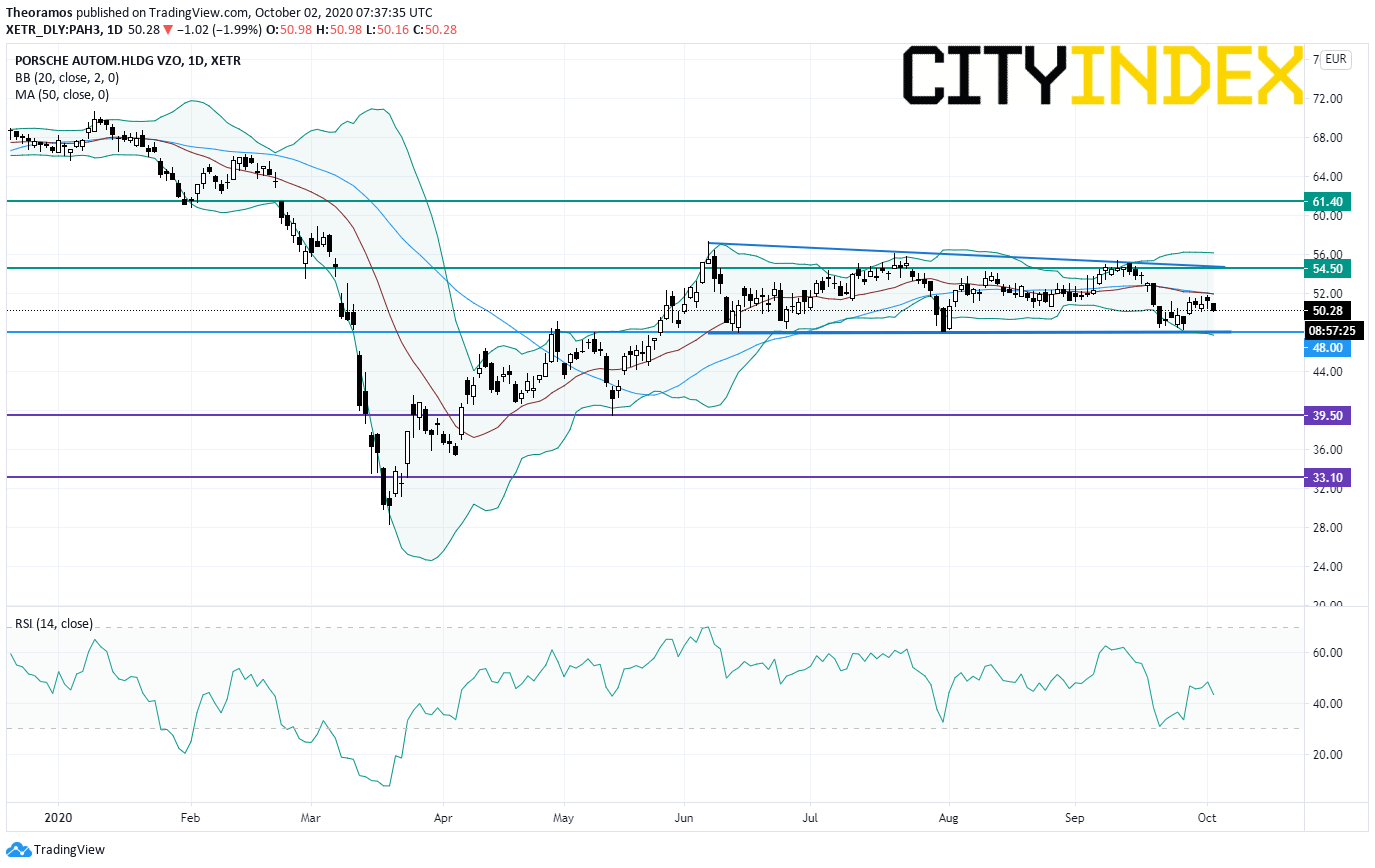

From a daily point of view, the stock is trading within a symmetrical triangle drawn since June. A break above the upper end of the symmetrical triangle at 54.5E (upward trigger threshold) would call for a new upleg towards the horizontal resistance at 61.4E. Alternatively, a break below the key support at 48E would invalidate the pattern.

#FRANCE#

Sanofi, a France-based pharmaceutical giant, said the European Medicines Agency (EMA) has accepted for review the Marketing Authorization Application (MAA) for the Company's avalglucosidase alfa for longterm enzyme replacement therapy for the treatment of patients with Pompe disease (acid a-glucosidase deficiency).

Assicurazioni Generali, an Italian insurance company, announced the appointment of its head of mergers & acquisitions.

#SWITZERLAND#

Dufry, a Swiss-based firm specializing in operating shops at airports, has its rating downgraded to "B+" from "BB-" and kept on "CreditWatch with Negative Implications" by S&P. The rating firm said: "As a result of the protracted travel disruption on the back of the COVID-19 outbreak, we now expect Dufry to only restore its revenues to the 2019 level by 2024."

Yesterday, European stocks closed mixed. The Stoxx Europe 600 Index rose 0.20%, France's CAC 40 climbed 0.43% and the U.K.'s FTSE 100 was up 0.23%, while Germany's DAX 30 fell 0.23%,

EUROPE ADVANCE/DECLINE

60% of STOXX 600 constituents traded higher yesterday.

48% of the shares trade above their 20D MA vs 42% Wednesday (below the 20D moving average).

56% of the shares trade above their 200D MA vs 55% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.48pt to 26.54, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Pers. & House. Goods

3mths relative low: Telecom., Insurance, Energy

Europe Best 3 sectors

utilities, technology, industrial goods & services

Europe worst 3 sectors

banks, energy, insurance

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.52% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -17bps (above its 20D MA).

ECONOMIC DATA

FR 07:45: Aug Budget Balance, exp.: E-151.04B

GE 09:00: Bundesbank Wuermeling speech

EC 10:00: Sep Core Inflation Rate YoY Flash, exp.: 0.4%

EC 10:00: Sep Inflation Rate YoY Flash, exp.: -0.2%

EC 10:00: Sep Inflation Rate MoM Flash, exp.: -0.4%

EC 11:00: ECB Guindos speech

MORNING TRADING

Both China and Hong Kong markets remained closed for a holiday. In Japan, the Tokyo Stock Exchange resumed stock trading which was halted for a whole day yesterday due to a technical glitch. The U.S. dollar bounced in Asian trading hours, as the ICE Dollar Index pushed above 93.90. House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin failed again to reach an agreement on a coronavirus stimulus package. Meanwhile, the House passed a 2.2-trillion-dollar Democratic coronavirus stimulus plan, which is unlikely to pass through the Republican-held Senate. EUR/USD dropped to 1.1715 and GBP/USD fell to 1.2860. USD/JPY rebounded to levels above 105.60. AUD/USD showed downward momentum testing the support at 0.7150. Official data showed that Australia's Retail Sales dropped 4.0% in August (-4.2% expected, -3.2% in July).

Spot gold declined to $1,890 an ounce.

U.S. President Donald Trump has announced he was tested positive for Covid-19.

#UK - IRELAND#

Ryanair, a budget airline, tweeted: "If the Irish Government does not fully adopt the EU travel regulations permitting unrestricted air travel to/from those regions of Europe that are Green or Amber from 13 Oct, then regrettably the Cork and Shannon bases will close on 26 Oct."

#GERMANY#

BMW, a German car maker, reported that its group U.S. sales dropped 8.7% on year in the third quarter.

Volkswagen, a German car maker, posted 3Q U.S. sales decline of 7.6% on year.

Porsche, a luxury car brand, said it sold 15,548 vehicles in the U.S. in the third quarter, up 5.0% on year.

From a daily point of view, the stock is trading within a symmetrical triangle drawn since June. A break above the upper end of the symmetrical triangle at 54.5E (upward trigger threshold) would call for a new upleg towards the horizontal resistance at 61.4E. Alternatively, a break below the key support at 48E would invalidate the pattern.

Source: TradingView, GAIN Capital

Sanofi, a France-based pharmaceutical giant, said the European Medicines Agency (EMA) has accepted for review the Marketing Authorization Application (MAA) for the Company's avalglucosidase alfa for longterm enzyme replacement therapy for the treatment of patients with Pompe disease (acid a-glucosidase deficiency).

#ITALY#

Assicurazioni Generali, an Italian insurance company, announced the appointment of its head of mergers & acquisitions.

#SWITZERLAND#

Dufry, a Swiss-based firm specializing in operating shops at airports, has its rating downgraded to "B+" from "BB-" and kept on "CreditWatch with Negative Implications" by S&P. The rating firm said: "As a result of the protracted travel disruption on the back of the COVID-19 outbreak, we now expect Dufry to only restore its revenues to the 2019 level by 2024."

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM