US Futures green - Watch M, AMC, AAL, HRB, PTON

The S&P 500 Futures remain on the upside after they closed higher yesterday.

U.S. ADP private jobs report for August will be today's focus (+1 million expected). Meanwhile, July factory orders (+6.1% on month expected) and the Federal Reserve's Beige Book will also be released.

European indices are posting a strong rebound in mid-day trading. The European Commission has posted July PPI at +0.6% (vs +0.5% expected). The German Federal Statistical Office has reported July retail sales at -0.9% on month (vs +0.5% expected). In the U.K., the Nationwide Building Society has released its House Price Index for August at +2.0% (vs +0.5% on month expected).

Asian indices closed in dispersed order. The Australian ASX closed on a strong up move despite that the Australian economy contracted 6.3% on year in the second quarter (vs -5.1% expected).

WTI Crude Oil futures remain in the green. The American Petroleum Institute (API) reported that U.S. crude-oil inventories dropped 6.36 million barrels in the week ending August 28 (-1.89 million barrels expected). Later today, the U.S. Energy Information Administration (EIA) will release official crude oil inventories data for the same week.

Gold consolidates as the US dollar gains ground on strong US economic data.

Gold fell 2.76 dollars (-0.14%) to 1967.42 dollars while the dollar index rose 0.28pt to 92.617 dollars.

U.S. Equity Snapshot

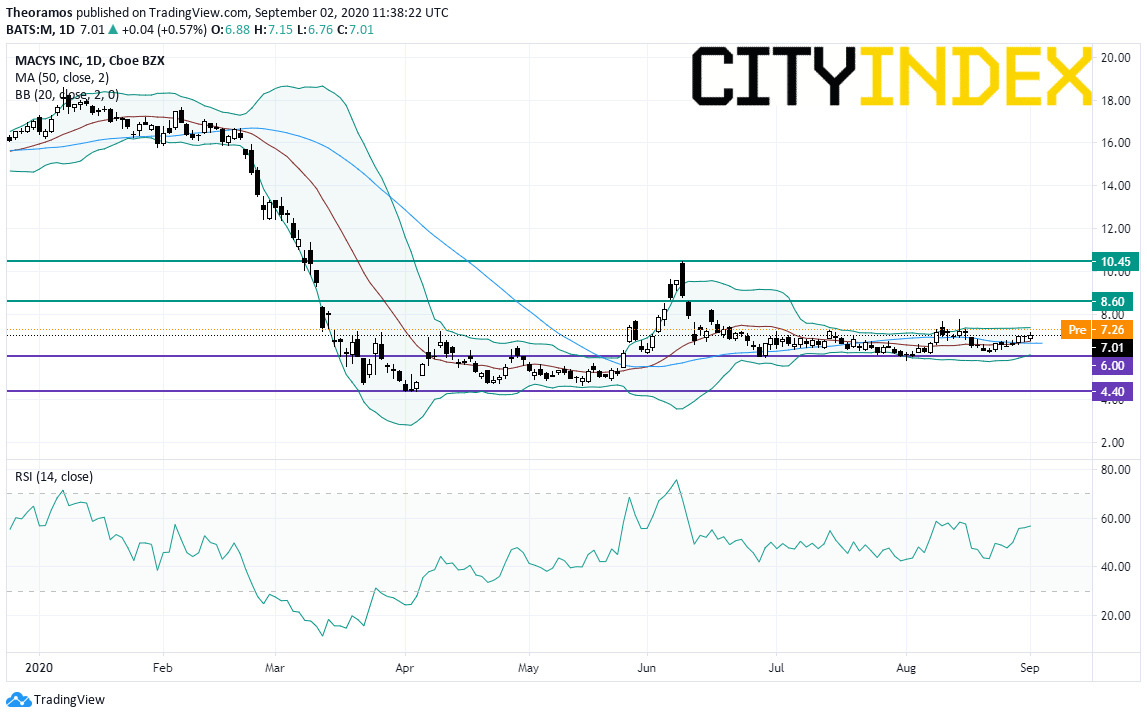

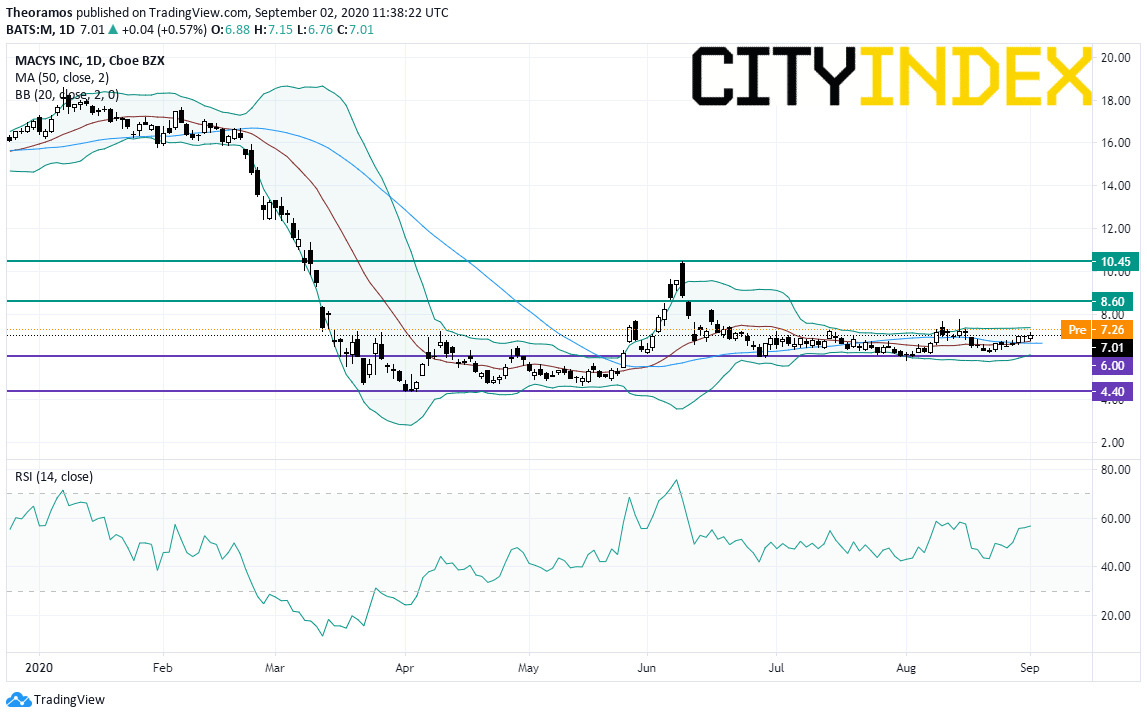

Macy's (M), the department store chain, is soaring before hours as quarterly earnings and sales beat estimates.

Source: TradingView, GAIN Capital

AMC Entertainment (AMC), the movie exhibition company, jumped after hours after saying that "70% of AMC Theatres U.S. Circuit would be opened by Friday, September 4, as approximately 140 additional locations reopen this week, including the first AMCs in California."

American Airlines Group (AAL) was downgraded to "sell" from "hold", Delta Air Lines to "hold" from "buy", Southwest Airlines to "hold" from "buy", all at Berenberg.

H&R Block (HRB), a provider of tax return services, disclosed first quarter adjusted EPS of 0.55 dollar, beating estimates, vs an adjusted LPS of 0.66 dollar a year ago, on revenue of 601.0 million dollars, also better than expected, up from 150.4 million dollars a year earlier.

Peloton Interactive (PTON)'s, the interactive fitness platform, price target was raised to 105 dollars from 58 dollars at JPMorgan.

U.S. ADP private jobs report for August will be today's focus (+1 million expected). Meanwhile, July factory orders (+6.1% on month expected) and the Federal Reserve's Beige Book will also be released.

European indices are posting a strong rebound in mid-day trading. The European Commission has posted July PPI at +0.6% (vs +0.5% expected). The German Federal Statistical Office has reported July retail sales at -0.9% on month (vs +0.5% expected). In the U.K., the Nationwide Building Society has released its House Price Index for August at +2.0% (vs +0.5% on month expected).

Asian indices closed in dispersed order. The Australian ASX closed on a strong up move despite that the Australian economy contracted 6.3% on year in the second quarter (vs -5.1% expected).

WTI Crude Oil futures remain in the green. The American Petroleum Institute (API) reported that U.S. crude-oil inventories dropped 6.36 million barrels in the week ending August 28 (-1.89 million barrels expected). Later today, the U.S. Energy Information Administration (EIA) will release official crude oil inventories data for the same week.

Gold consolidates as the US dollar gains ground on strong US economic data.

Gold fell 2.76 dollars (-0.14%) to 1967.42 dollars while the dollar index rose 0.28pt to 92.617 dollars.

U.S. Equity Snapshot

Macy's (M), the department store chain, is soaring before hours as quarterly earnings and sales beat estimates.

Source: TradingView, GAIN Capital

AMC Entertainment (AMC), the movie exhibition company, jumped after hours after saying that "70% of AMC Theatres U.S. Circuit would be opened by Friday, September 4, as approximately 140 additional locations reopen this week, including the first AMCs in California."

American Airlines Group (AAL) was downgraded to "sell" from "hold", Delta Air Lines to "hold" from "buy", Southwest Airlines to "hold" from "buy", all at Berenberg.

H&R Block (HRB), a provider of tax return services, disclosed first quarter adjusted EPS of 0.55 dollar, beating estimates, vs an adjusted LPS of 0.66 dollar a year ago, on revenue of 601.0 million dollars, also better than expected, up from 150.4 million dollars a year earlier.

Peloton Interactive (PTON)'s, the interactive fitness platform, price target was raised to 105 dollars from 58 dollars at JPMorgan.