EU indices significantly up | TA focus on Kingspan

INDICES

Yesterday, European stocks were mixed. The Stoxx Europe 600 Index advanced 0.2% and Germany's DAX 30 added 0.2%, while France's CAC 40 fell 0.2% and the U.K.'s FTSE 100 sank 1.7%.

EUROPE ADVANCE/DECLINE

61% of STOXX 600 constituents traded lower or unchanged yesterday.

42% of the shares trade above their 20D MA vs 48% Monday (below the 20D moving average).

50% of the shares trade above their 200D MA vs 54% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.4pt to 27.12, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Chemicals, Technology

3mths relative low: Telecom

Europe Best 3 sectors

technology, basic resources, real estate

Europe worst 3 sectors

travel & leisure, banks, media

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.4% (above its 20D MA). The 2yr-10yr yield spread fell 0bp to -26bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Jul Retail Sales YoY, exp.: 5.9%

GE 07:00: Jul Retail Sales MoM, exp.: -1.6%

UK 07:00: Aug Nationwide Housing Prices YoY, exp.: 1.5%

UK 07:00: Aug Nationwide Housing Prices MoM, exp.: 1.7%

EC 10:00: Jul PPI MoM, exp.: 0.7%

EC 10:00: Jul PPI YoY, exp.: -3.7%

GE 10:40: 5-Year Bobl auction, exp.: -0.72%

UK 15:30: BoE Broadbent speech

UK 16:30: BoE Haldane speech

MORNING TRADING

In Asian trading hours, EUR/USD fell 1.1909 and GBP/USD slipped to 1.3380. USD/JPY bounced to 106.05. AUD/USD dropped to 0.7352. This morning, official data showed that the Australian economy contracted 6.3% on year in the second quarter (-5.1% expected).

Spot gold slid to $1,966 an ounce.

#UK - IRELAND#

Computacenter, a computer services provider, released a trading update: "The successful trading performance seen in the first half of the year has continued for the first two months of the second half. As we consolidate our forecasts for the rest of the year, it has become clear to the Board that the likely out turn for the year as a whole will be materially above the Board's previous expectations as set out in the Group's Trading Update Statement announced on 22 July 2020."

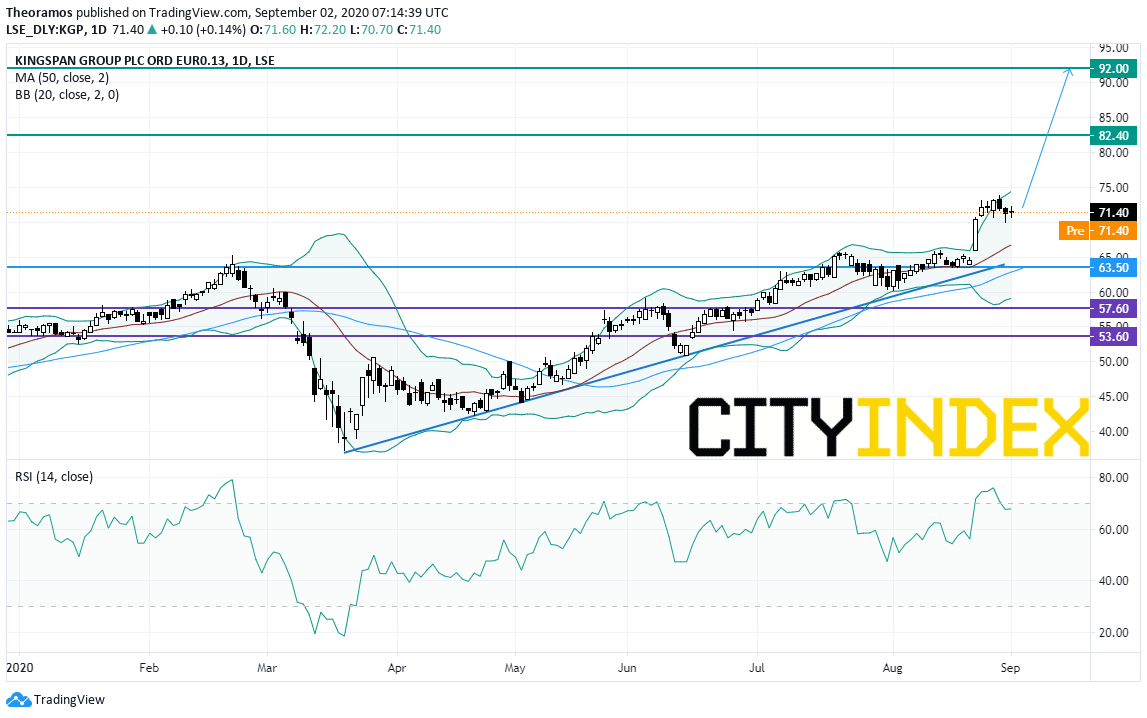

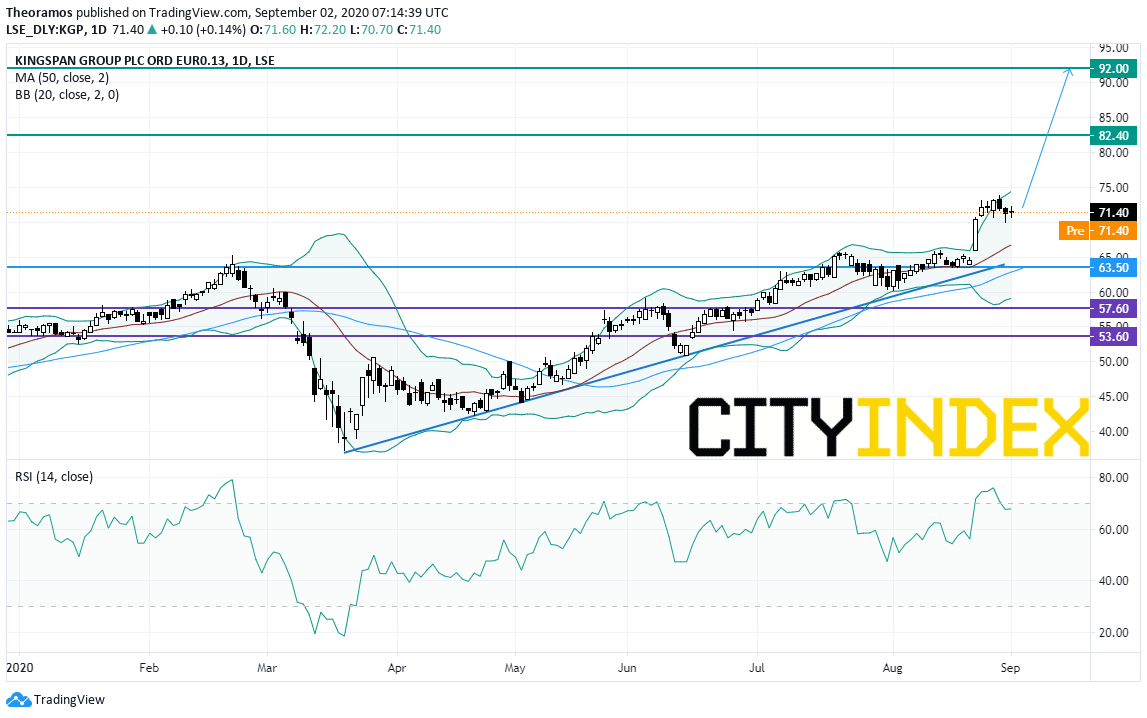

Kingspan, a building materials company, was downgraded to "neutral" from "overweight" at JPMorgan.

From a daily point of view, the share is supported by a rising trend line drawn since March. In addition, the 50DMA is playing a support role below the stock. Above the previous top of July and August at 63.5E targets are set at 82.4E and 92E in extension.

Source: GAIN Capital, TradingView

#GERMANY#

Vonovia, a real estate group, will replace health care company Fresenius in the Euro STOXX 50 Index, effective from September 21, according to STOXX.

#FRANCE#

Pernod Ricard, an alcoholic beverages producer, will be added to the Euro STOXX 50 Index, while banking group Societe Generale and telecom Orange will be removed, effective from September 21, according to STOXX.

Pernod Ricard announced that full-year net income declined 77.0% on year to 329 million euros, citing 1 billion euros asset impairment triggered by Covid-19. Profit from recurring operations fell 12.4% to 2.26 billion euros on revenue of 8.45 billion euros, down 8.0% (-9.5% organic growth). The company proposed a dividend of 2.66 euros per share. Regarding the outlook, the company said: "For FY21, Pernod Ricard expects continued uncertainty and volatility, in particular relating to sanitary conditions and their impact on social gatherings, as well as challenging economic conditions."

BioMerieux, a biotechnology company, reported that 1H net income increased 23.0% on year to 173 million euros and operating income climbed 22.7% to 232 million euros on revenue of 1.48 billion euros, up 15.8% (+15.7% organic growth). Regarding the outlook, the company stated: "Based on the robust first-half performance and the nature of bioMerieux's business, the favorable impact on financial results is expected to continue in the second half."

Eiffage, a civil engineering construction group, was upgraded to "neutral" from "sell" at Goldman Sachs.

#SPAIN#

BBVA, a Spanish banking group, and Spanish telecom Telefonica will be removed from the Euro STOXX 50 Index, effective from September 21, according to STOXX.

Bankinter, a Spanish bank, was downgraded to "underweight" from "neutral" at JPMorgan.

Siemens Gamesa, a wind turbine manufacturer, was upgraded to "buy" from "neutral" at Goldman Sachs.

#BENELUX#

Adyen, a Dutch payment company, and internet group Prosus will be added to the Euro STOXX 50 Index, effective from September 21, according to STOXX.

#ITALY#

UnipolSai, an insurance company, was downgraded to "hold" from "buy" at Societe Generale.

#SWITZERLAND#

Credit Suisse, a banking group, issued a statement in response to the announcement by Swiss regulator Finma: "Credit Suisse takes note of the decision announced today by Finma to open enforcement proceedings in the context of the 'observation matter'. Credit Suisse will continue to fully cooperate with Finma." Previously, Finma appointed an independent auditor to investigate Credit Suisse in the context of observation activities, which raised various compliance issues.

#FINLAND#

Kone, an engineering company based in Finland, will be added to the Euro STOXX 50 Index, effective from September 21, according to STOXX.

EX-DIVIDEND

Linde Plc (LIN): $0.963

Yesterday, European stocks were mixed. The Stoxx Europe 600 Index advanced 0.2% and Germany's DAX 30 added 0.2%, while France's CAC 40 fell 0.2% and the U.K.'s FTSE 100 sank 1.7%.

EUROPE ADVANCE/DECLINE

61% of STOXX 600 constituents traded lower or unchanged yesterday.

42% of the shares trade above their 20D MA vs 48% Monday (below the 20D moving average).

50% of the shares trade above their 200D MA vs 54% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.4pt to 27.12, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Chemicals, Technology

3mths relative low: Telecom

Europe Best 3 sectors

technology, basic resources, real estate

Europe worst 3 sectors

travel & leisure, banks, media

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.4% (above its 20D MA). The 2yr-10yr yield spread fell 0bp to -26bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Jul Retail Sales YoY, exp.: 5.9%

GE 07:00: Jul Retail Sales MoM, exp.: -1.6%

UK 07:00: Aug Nationwide Housing Prices YoY, exp.: 1.5%

UK 07:00: Aug Nationwide Housing Prices MoM, exp.: 1.7%

EC 10:00: Jul PPI MoM, exp.: 0.7%

EC 10:00: Jul PPI YoY, exp.: -3.7%

GE 10:40: 5-Year Bobl auction, exp.: -0.72%

UK 15:30: BoE Broadbent speech

UK 16:30: BoE Haldane speech

MORNING TRADING

In Asian trading hours, EUR/USD fell 1.1909 and GBP/USD slipped to 1.3380. USD/JPY bounced to 106.05. AUD/USD dropped to 0.7352. This morning, official data showed that the Australian economy contracted 6.3% on year in the second quarter (-5.1% expected).

Spot gold slid to $1,966 an ounce.

#UK - IRELAND#

Computacenter, a computer services provider, released a trading update: "The successful trading performance seen in the first half of the year has continued for the first two months of the second half. As we consolidate our forecasts for the rest of the year, it has become clear to the Board that the likely out turn for the year as a whole will be materially above the Board's previous expectations as set out in the Group's Trading Update Statement announced on 22 July 2020."

Kingspan, a building materials company, was downgraded to "neutral" from "overweight" at JPMorgan.

From a daily point of view, the share is supported by a rising trend line drawn since March. In addition, the 50DMA is playing a support role below the stock. Above the previous top of July and August at 63.5E targets are set at 82.4E and 92E in extension.

Source: GAIN Capital, TradingView

#GERMANY#

Vonovia, a real estate group, will replace health care company Fresenius in the Euro STOXX 50 Index, effective from September 21, according to STOXX.

#FRANCE#

Pernod Ricard, an alcoholic beverages producer, will be added to the Euro STOXX 50 Index, while banking group Societe Generale and telecom Orange will be removed, effective from September 21, according to STOXX.

Pernod Ricard announced that full-year net income declined 77.0% on year to 329 million euros, citing 1 billion euros asset impairment triggered by Covid-19. Profit from recurring operations fell 12.4% to 2.26 billion euros on revenue of 8.45 billion euros, down 8.0% (-9.5% organic growth). The company proposed a dividend of 2.66 euros per share. Regarding the outlook, the company said: "For FY21, Pernod Ricard expects continued uncertainty and volatility, in particular relating to sanitary conditions and their impact on social gatherings, as well as challenging economic conditions."

BioMerieux, a biotechnology company, reported that 1H net income increased 23.0% on year to 173 million euros and operating income climbed 22.7% to 232 million euros on revenue of 1.48 billion euros, up 15.8% (+15.7% organic growth). Regarding the outlook, the company stated: "Based on the robust first-half performance and the nature of bioMerieux's business, the favorable impact on financial results is expected to continue in the second half."

Eiffage, a civil engineering construction group, was upgraded to "neutral" from "sell" at Goldman Sachs.

#SPAIN#

BBVA, a Spanish banking group, and Spanish telecom Telefonica will be removed from the Euro STOXX 50 Index, effective from September 21, according to STOXX.

Bankinter, a Spanish bank, was downgraded to "underweight" from "neutral" at JPMorgan.

Siemens Gamesa, a wind turbine manufacturer, was upgraded to "buy" from "neutral" at Goldman Sachs.

#BENELUX#

Adyen, a Dutch payment company, and internet group Prosus will be added to the Euro STOXX 50 Index, effective from September 21, according to STOXX.

#ITALY#

UnipolSai, an insurance company, was downgraded to "hold" from "buy" at Societe Generale.

#SWITZERLAND#

Credit Suisse, a banking group, issued a statement in response to the announcement by Swiss regulator Finma: "Credit Suisse takes note of the decision announced today by Finma to open enforcement proceedings in the context of the 'observation matter'. Credit Suisse will continue to fully cooperate with Finma." Previously, Finma appointed an independent auditor to investigate Credit Suisse in the context of observation activities, which raised various compliance issues.

#FINLAND#

Kone, an engineering company based in Finland, will be added to the Euro STOXX 50 Index, effective from September 21, according to STOXX.

EX-DIVIDEND

Linde Plc (LIN): $0.963

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM