US Futures falling, watch AMZN, AAPL, GILD, HON, XOM, CVX, V

The S&P 500 Futures remain under pressure after they pared a part of gains made in the prior sessions yesterday. Market sentiment was dampened by a series of downbeat economic data.

Later today, latest data on the Markit U.S. Manufacturing Purchasing Managers' Index (36.7 expected), the Institute for Supply Management (ISM) Manufacturing PMI (36.0 expected), and Construction Spending (-3.5% on month expected) will be reported.

European indices are mostly closed for Labor Day except the U.K. Research firm Markit has published final readings of April Manufacturing PMI for the U.K. at 32.6 (vs 32.8 expected). The Nationwide Building Society has published its house price index for April at +0.7% (vs -0.3% on month expected). The Bank of England has released the number of mortgage approvals in March at 56,200 (vs 58,000 expected).

Asian indices were mostly closed except the Japanese Nikkei and the Australian ASX which faced huge drops.

WTI Crude Oil Futures remain on the upside. Standard Chartered Bank said emerging supply cuts from the U.S., Canada and Norway are positive signal for oil prices.

Gold fell 1.8 dollar (-0.11%) to 1684.7 dollars, set for weekly loss on hopes of easing lockdown restrictions.

The US dollar is consolidating against its major peers, the EUR/USD rose 25pips to 1.098 and USD/JPY fell 39pips to 106.79.

US Equity Snapshot

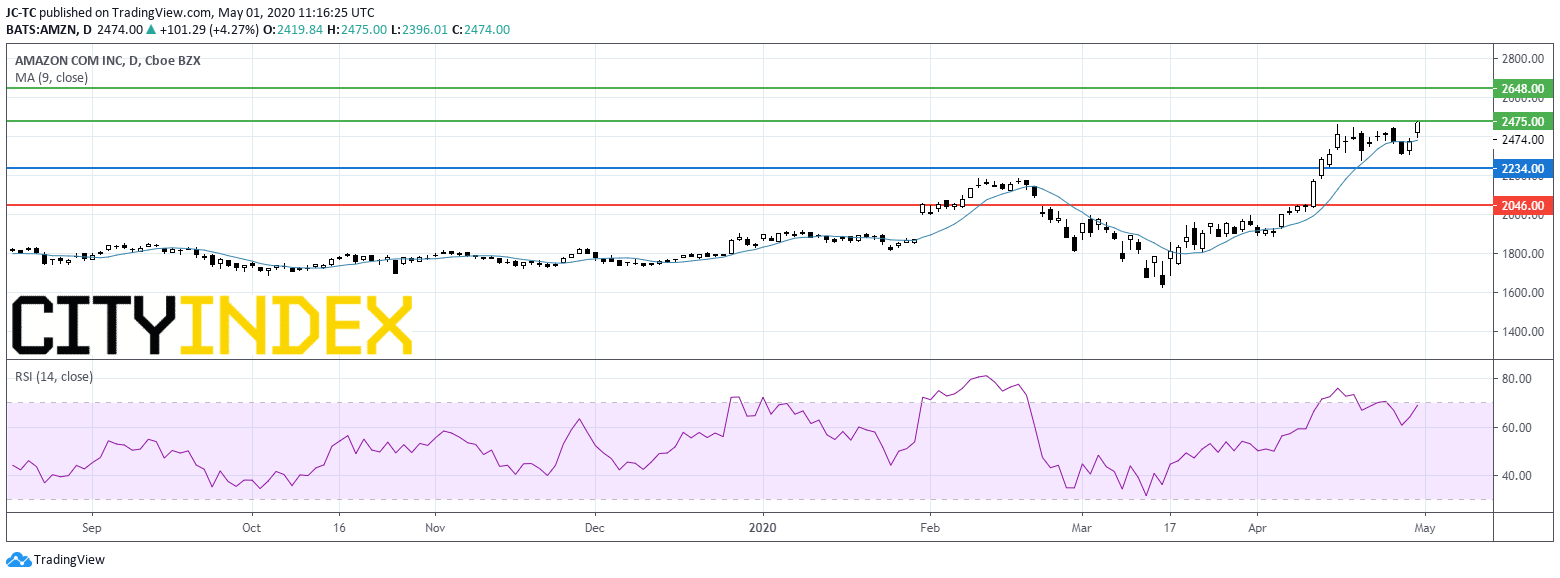

Amazon.com (AMZN), the world's largest online retailer and web services provider, dropped after hours after posting announced first quarter EPS of 5.01 dollars, significantly missing the estimate, down from 7.09 dollars a year ago. Net sales were up to 75.5 billion dollars, better than expected, from 59.7 billion dollars in the previous year. The company "expects to spend the entirety" of second quarter profits on COVID-related expenses.

Apple (AAPL), the consumer electronics giant, lost some ground in extended trading as the company did not provide forecast following its earnings report, for the first time in more than a decade. Apple posted second quarter EPS up to 2.55 dollars, beating forecasts, from 2.46 dollars a year ago, on sales of 58.3 billion dollars, higher than expected, slightly up from 58.0 billion dollars a year earlier. iPhone sales fell 7% from a year ago.

Gilead Sciences (GILD), the biopharmaceutical company, reported first quarter adjusted EPS of 1.68 dollar, above expectations, down from 1.76 dollar in the prior-year period on revenue of 5.55 billion dollars, up 5.1% on year. The company said it expanded remdesivir manufacturing production and expects that more than 140,000 treatment courses of remdesivir will be manufactured by the end of May. CEO Daniel O'Day said the company may spend 1 billion dollar this year on remdesivir. The stock was downgraded to "neutral" from "overweight" at JPMorgan.

Honeywell (HON), the industrial conglomerate, posted first quarter EPS up to 2.21 dollars from 1.92 dollar a year earlier, above expectations. Sales fell 5% to 8.46 billion dollars, missing estimates. The company suspended its full year guidance.

Exxon Mobil (XOM), the oil and gas company, unveiled a first quarter loss of 610 million dollars, or 0.14 dollar a share, vs a 2.35 billion dollars net income a year earlier. The company said "Capex is now expected to be approximately 23 billion dollars for the year, down from the previously announced guidance of 33 billion dollars."

Chevron (CVX), the energy corporation, "is further reducing its 2020 capital expenditure guidance by up to 2 billion dollars to 14 billion dollars", adding that "financial results in future periods are expected to be depressed as long as current market conditions persist." Separately, the company reported first quarter EPS up to 1.93 dollar from 1.39 dollar a year earlier, on sales down 31.5 billion dollars from 35.2 billion dollars a year ago.

Visa (V), the credit card company, disclosed second quarter adjusted EPS of 1.39 dollar, above the consensus, up from 1.31 dollar a year ago on net sales of 5.9 billion dollars, slightly above forecasts, up from 5.5 billion dollars a year earlier. Yet, the stock slightly fell after hours.The company warned on challenging "number of quarters" to come.

Amgen (AMGN), the developer of biotechnology medicines, released first quarter adjusted EPS of 4.17 dollars, exceeding estimates, up from 3.56 dollars a year ago on revenue of 6.2 billion dollars, higher than anticipated, up from 5.6 billion dollars a year earlier. The stock gained ground in extended trading.

United Airlines (UAL), the airline group, announced first quarter adjusted LPS of 2.57 dollars, below estimates, from an EPS of 1.15 dollar a year ago, on operating revenue of 7.98 billion dollars, slightly above expectations, down from 9.59 billion dollars a year earlier. The company added that it expects daily cash burn to average between 40 million and 45 million dollars during the second quarter.

Later today, latest data on the Markit U.S. Manufacturing Purchasing Managers' Index (36.7 expected), the Institute for Supply Management (ISM) Manufacturing PMI (36.0 expected), and Construction Spending (-3.5% on month expected) will be reported.

European indices are mostly closed for Labor Day except the U.K. Research firm Markit has published final readings of April Manufacturing PMI for the U.K. at 32.6 (vs 32.8 expected). The Nationwide Building Society has published its house price index for April at +0.7% (vs -0.3% on month expected). The Bank of England has released the number of mortgage approvals in March at 56,200 (vs 58,000 expected).

Asian indices were mostly closed except the Japanese Nikkei and the Australian ASX which faced huge drops.

WTI Crude Oil Futures remain on the upside. Standard Chartered Bank said emerging supply cuts from the U.S., Canada and Norway are positive signal for oil prices.

Gold fell 1.8 dollar (-0.11%) to 1684.7 dollars, set for weekly loss on hopes of easing lockdown restrictions.

The US dollar is consolidating against its major peers, the EUR/USD rose 25pips to 1.098 and USD/JPY fell 39pips to 106.79.

US Equity Snapshot

Amazon.com (AMZN), the world's largest online retailer and web services provider, dropped after hours after posting announced first quarter EPS of 5.01 dollars, significantly missing the estimate, down from 7.09 dollars a year ago. Net sales were up to 75.5 billion dollars, better than expected, from 59.7 billion dollars in the previous year. The company "expects to spend the entirety" of second quarter profits on COVID-related expenses.

Apple (AAPL), the consumer electronics giant, lost some ground in extended trading as the company did not provide forecast following its earnings report, for the first time in more than a decade. Apple posted second quarter EPS up to 2.55 dollars, beating forecasts, from 2.46 dollars a year ago, on sales of 58.3 billion dollars, higher than expected, slightly up from 58.0 billion dollars a year earlier. iPhone sales fell 7% from a year ago.

Gilead Sciences (GILD), the biopharmaceutical company, reported first quarter adjusted EPS of 1.68 dollar, above expectations, down from 1.76 dollar in the prior-year period on revenue of 5.55 billion dollars, up 5.1% on year. The company said it expanded remdesivir manufacturing production and expects that more than 140,000 treatment courses of remdesivir will be manufactured by the end of May. CEO Daniel O'Day said the company may spend 1 billion dollar this year on remdesivir. The stock was downgraded to "neutral" from "overweight" at JPMorgan.

Honeywell (HON), the industrial conglomerate, posted first quarter EPS up to 2.21 dollars from 1.92 dollar a year earlier, above expectations. Sales fell 5% to 8.46 billion dollars, missing estimates. The company suspended its full year guidance.

Exxon Mobil (XOM), the oil and gas company, unveiled a first quarter loss of 610 million dollars, or 0.14 dollar a share, vs a 2.35 billion dollars net income a year earlier. The company said "Capex is now expected to be approximately 23 billion dollars for the year, down from the previously announced guidance of 33 billion dollars."

Chevron (CVX), the energy corporation, "is further reducing its 2020 capital expenditure guidance by up to 2 billion dollars to 14 billion dollars", adding that "financial results in future periods are expected to be depressed as long as current market conditions persist." Separately, the company reported first quarter EPS up to 1.93 dollar from 1.39 dollar a year earlier, on sales down 31.5 billion dollars from 35.2 billion dollars a year ago.

Visa (V), the credit card company, disclosed second quarter adjusted EPS of 1.39 dollar, above the consensus, up from 1.31 dollar a year ago on net sales of 5.9 billion dollars, slightly above forecasts, up from 5.5 billion dollars a year earlier. Yet, the stock slightly fell after hours.The company warned on challenging "number of quarters" to come.

Amgen (AMGN), the developer of biotechnology medicines, released first quarter adjusted EPS of 4.17 dollars, exceeding estimates, up from 3.56 dollars a year ago on revenue of 6.2 billion dollars, higher than anticipated, up from 5.6 billion dollars a year earlier. The stock gained ground in extended trading.

United Airlines (UAL), the airline group, announced first quarter adjusted LPS of 2.57 dollars, below estimates, from an EPS of 1.15 dollar a year ago, on operating revenue of 7.98 billion dollars, slightly above expectations, down from 9.59 billion dollars a year earlier. The company added that it expects daily cash burn to average between 40 million and 45 million dollars during the second quarter.

Source : TradingView, GAIN Capital

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM