U.S Futures rising - Watch PEP, AMZN, AAL, ALL, GS

Later today, the Labor Department will report Initial Jobless Claims (a decline to 850,000 expected) and Continuing Claims (a decline to 12.200 million expected). Personal Income for August is expected to slip 2.5% on month. The Markit U.S. Manufacturing Purchasing Managers' Index for the September (final reading) is expected to remain at 53.5.

European indices are slightly on the upside. The European Commission has confirmed starting the process to take the U.K. into court over its Internal Market Bill. The Markit Germany Manufacturing Purchasing Managers' Index (PMI) for September was released at 56.4 (vs 56.6 expected). The Markit European Manufacturing PMI for September was published at 53.7, as expected. The August Unemployment rate was at 8.1%, as expected. The Markit U.K. Manufacturing PMI for September was released at 54.1, vs 54.3 expected.

Both China and Hong Kong markets were closed for a holiday. The Japanese Nikkei closed earlier due to technical outage. The Australian ASX closed in the green. The Australian Industry Group Performance of Manufacturing Index decline to 46.7 in September from 49.3 in August. The Bank of Japan Tankan Large Manufacturers Index posted -27 for the third quarter (-24 expected) and the Outlook Index was -17 (-16 expected).

WTI Crude Oil futures are rebounding. The U.S. Energy Information Administration reported that crude-oil stockpiles were down 2 million barrels last week, in contrast to an addition of 1.6 million barrels expected.

Gold remains firm as the US dollar loses ground on US stimulus hopes.

Gold rose 13.74 dollars (+0.73%) to 1899.56 dollars while the dollar index fell 0.1pt to 93.783.

U.S. Equity Snapshot

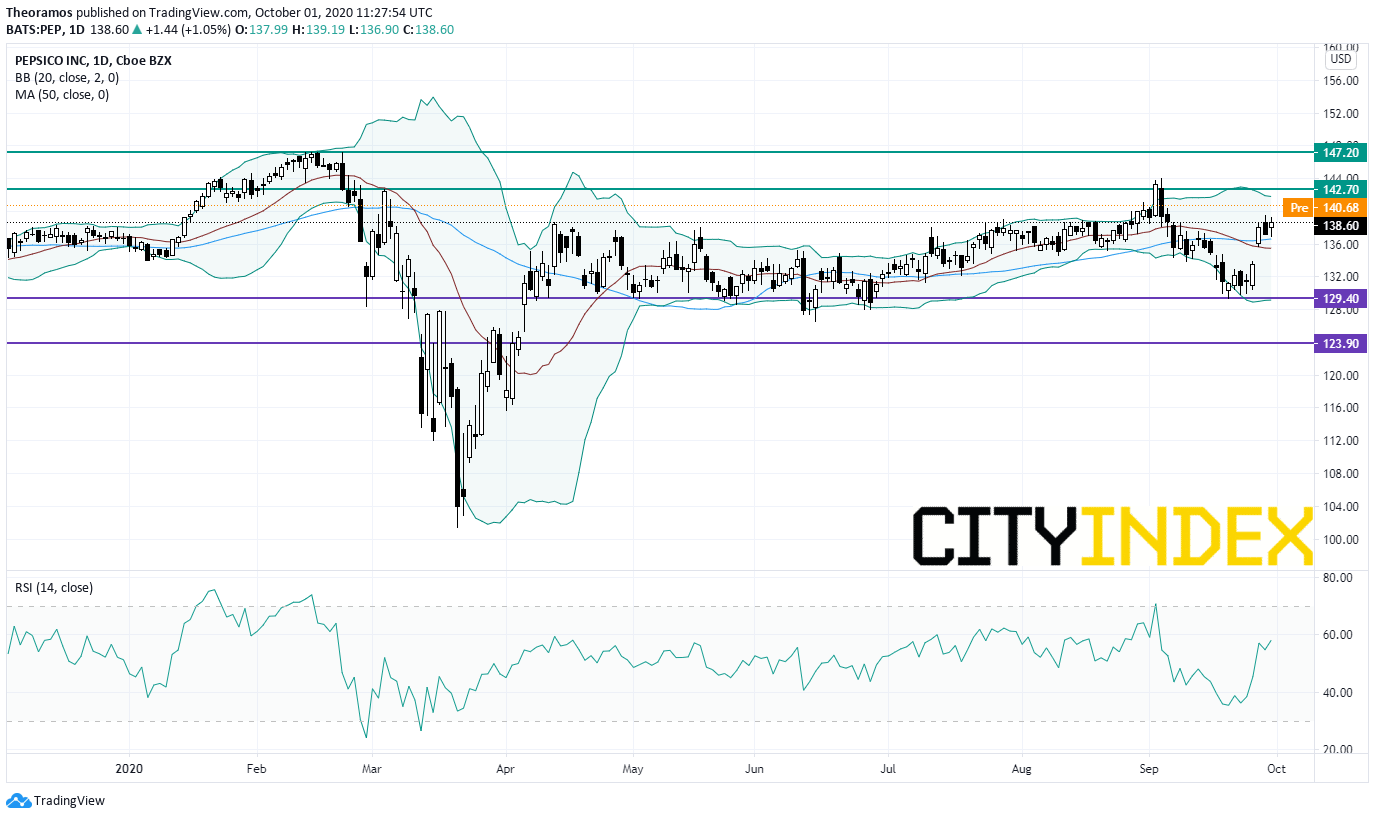

Pepsico (PEP), the international beverage and food company, pops before hours after reporting better-than-expected third quarter earnings and boosting full-year guidance.

Source: TradingView, GAIN Capital

Amazon.com's (AMZN) price target was raised to 4,500 dollars from 3,925 dollars at Pivotal Research.

American Airlines' (AAL) CEO said the airline will start cutting 19,000 jobs as of today. This process could be reversed if Government's aid would be extended in the coming days. United Airlines (UAL) is also beginning to cut 13,000 jobs.

Allstate (ALL), the insurance company, plans to cut 3,800 jobs or 8% of its workforce.

Goldman Sachs (GS), the banking group, might cut 400 jobs, or 1% of its workforce, according to Bloomberg.