US Futures broadly up - Watch ZM, AAPL, QCOM

The S&P 500 Futures are up again after they closed mixed yesterday. Nasdaq 100 hit a fresh record high while the Dow Jones Industrial Average dropped 223 points (-0.8%) and the S&P 500 fell 7 points (+0.2%) to 3500.

Later today, the U.S. Commerce Department will report July construction spending (+1.1% on month expected). The Institute for Supply Management will post August Manufacturing PMI (54.5 expected). Research firm Markit will publish final readings of August Manufacturing PMI (53.6 expected).

European indices have rebounded at the open before facing a consolidation. German Government has revised its 2020 GDP forecast to -5.8%, vs -6.3% previously. It also revised its 2021 GDP forecast to +4.4%, vs +5.2%. Research firm Markit has published final readings of August Manufacturing PMI for the eurozone at 51.7 (as expected), for Germany at 52.2 (vs 53.0 expected), for France at 49.8 (vs 49.0 expected) and for the U.K. at 55.2 (vs 55.3 expected). The European Commission has posted August CPI at -0.2% (vs +0.2% on year expected) and July jobless rate at 7.9% (vs 8.0% expected). The German Federal Statistical Office has reported August jobless rate at 6.4%, as expected. The Bank of England has released the number of mortgage approvals for July at 66,300 (vs 55,500 expected).

Asian indices closed slightly on the upside except the Australian ASX. The Reserve Bank of Australia held its rates unchanged, as expected. Data released earlier today showed that China's Caixin Manufacturing PMI rose to 53.1 in August (52.5 expected), the highest level since January 2011.

WTI Crude Oil futures are rebounding. Abu Dhabi, the biggest oil producer in the United Arab Emirates, said it will reduce exports in that month by 30% below contracted amounts for buyers with long-term agreements. Later today, American Petroleum Institute (API) would release the change of U.S. oil stockpile data for August 28.

Gold is well oriented, trading at two-week high, while the US dollar declines on low rates outlook.

Gold rose 21.56 dollars (+1.1%) to 1989.37 dollars.

The dollar index fell 0.32pt to 91.826.

U.S. Equity Snapshot

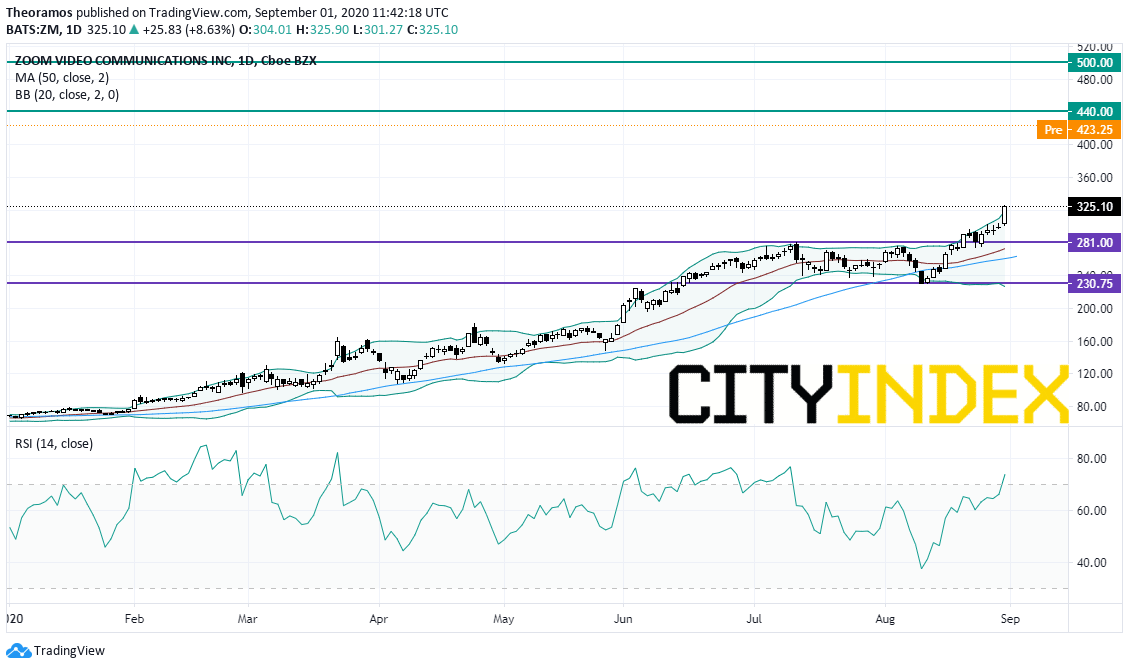

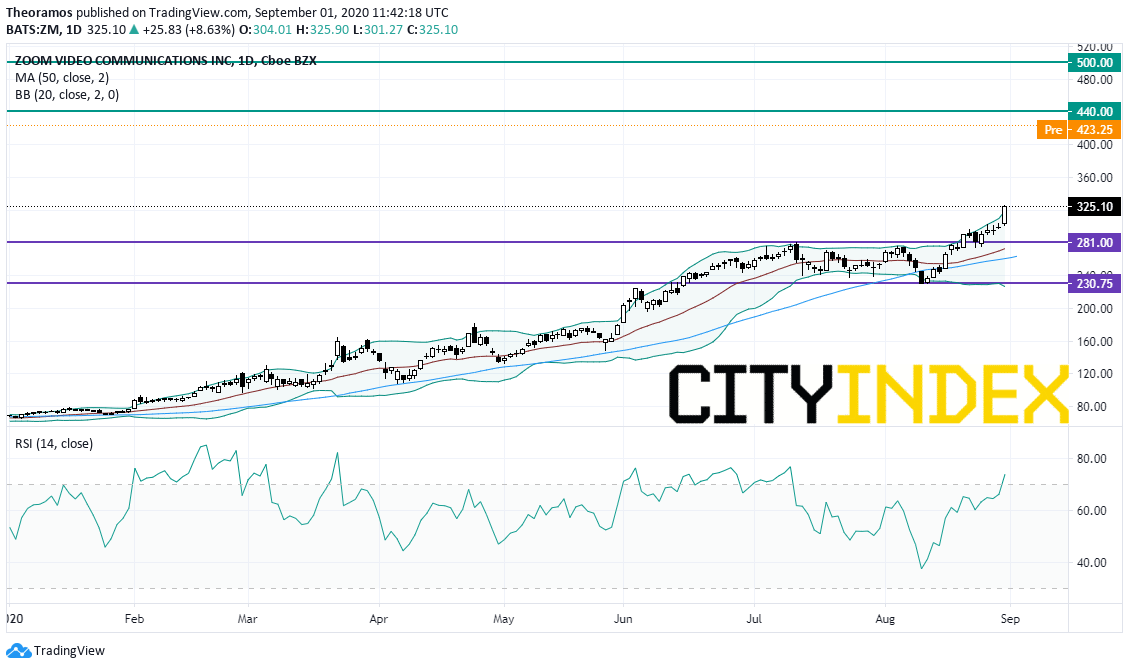

Zoom Video Communications (ZM), the leader in modern enterprise video communications, soared in extended trading after reporting second quarter adjusted EPS of 0.92 dollar, significantly beating estimates, up from 0.02 dollar last year, on revenue of 663.5 million dollars, also exceeding forecasts, up from 145.8 million dollars a year earlier. The Co raised its third quarter and full year adjusted EPS and revenue forecast.

Source: TradingView, GAIN Capital

Apple (AAPL): according to Bloomberg, the tech giant would ship 75 million 5G IPhones for late year.

QUALCOMM (QCOM), a maker of digital wireless communications equipment, is gaining ground before hours as the stock was upgraded to "equal weight" from "underweight" at Wells Fargo.

Later today, the U.S. Commerce Department will report July construction spending (+1.1% on month expected). The Institute for Supply Management will post August Manufacturing PMI (54.5 expected). Research firm Markit will publish final readings of August Manufacturing PMI (53.6 expected).

European indices have rebounded at the open before facing a consolidation. German Government has revised its 2020 GDP forecast to -5.8%, vs -6.3% previously. It also revised its 2021 GDP forecast to +4.4%, vs +5.2%. Research firm Markit has published final readings of August Manufacturing PMI for the eurozone at 51.7 (as expected), for Germany at 52.2 (vs 53.0 expected), for France at 49.8 (vs 49.0 expected) and for the U.K. at 55.2 (vs 55.3 expected). The European Commission has posted August CPI at -0.2% (vs +0.2% on year expected) and July jobless rate at 7.9% (vs 8.0% expected). The German Federal Statistical Office has reported August jobless rate at 6.4%, as expected. The Bank of England has released the number of mortgage approvals for July at 66,300 (vs 55,500 expected).

Asian indices closed slightly on the upside except the Australian ASX. The Reserve Bank of Australia held its rates unchanged, as expected. Data released earlier today showed that China's Caixin Manufacturing PMI rose to 53.1 in August (52.5 expected), the highest level since January 2011.

WTI Crude Oil futures are rebounding. Abu Dhabi, the biggest oil producer in the United Arab Emirates, said it will reduce exports in that month by 30% below contracted amounts for buyers with long-term agreements. Later today, American Petroleum Institute (API) would release the change of U.S. oil stockpile data for August 28.

Gold is well oriented, trading at two-week high, while the US dollar declines on low rates outlook.

Gold rose 21.56 dollars (+1.1%) to 1989.37 dollars.

The dollar index fell 0.32pt to 91.826.

U.S. Equity Snapshot

Zoom Video Communications (ZM), the leader in modern enterprise video communications, soared in extended trading after reporting second quarter adjusted EPS of 0.92 dollar, significantly beating estimates, up from 0.02 dollar last year, on revenue of 663.5 million dollars, also exceeding forecasts, up from 145.8 million dollars a year earlier. The Co raised its third quarter and full year adjusted EPS and revenue forecast.

Source: TradingView, GAIN Capital

Apple (AAPL): according to Bloomberg, the tech giant would ship 75 million 5G IPhones for late year.

QUALCOMM (QCOM), a maker of digital wireless communications equipment, is gaining ground before hours as the stock was upgraded to "equal weight" from "underweight" at Wells Fargo.

Latest market news

Today 08:33 AM

Yesterday 11:48 PM

Yesterday 11:16 PM