Guaranteed Stop Loss Orders FAQs

Looking for something specific?

Use our advanced search to explore support pages- What is a guaranteed stop loss order?

- How does using a GSLO fit into my trading plan?

- Guaranteed stop loss order example

- What markets do guaranteed stop loss orders cover?

- How much does a guaranteed stop loss order cost?

- How do I place a GSLO?

- Can I change my GSLO after making a trade?

- Can I add a GSLO to an existing position?

- Can I cancel a GSLO?

What is a guaranteed stop loss order?

A guaranteed stop loss order is an order that closes your trade at an exact level chosen by you, regardless of market gapping, and is a popular risk management technique. GSLOs can be beneficial as regular stop losses may incur slippage - resulting in a trade getting filled at a less desirable price than your requested stop.

Trading with guaranteed stop loss orders at City Index enables a cost-effective way to manage your risk over 13,500 global markets. There is no upfront charge for attaching a guaranteed stop loss order to your market order and you will only be charged if your GSLO is triggered.

How does using a GSLO fit into my trading plan?

GSLOs can form an important part of a trading plan since risk management is a crucial consideration in any trading strategy, especially when you are a less experienced trader. Trading the financial markets is similar to running a business and ensuring you have the right protection against losses is fundamental to ensuring you don’t lose too much too quickly.

GSLOs are particularly beneficial in volatile markets or at times of extreme volatility where there is a risk of the markets gapping. They can also help ensure that you don’t risk more than your initial deposit by capping any potential loss at a risk level set by you.

Guaranteed stop loss order example

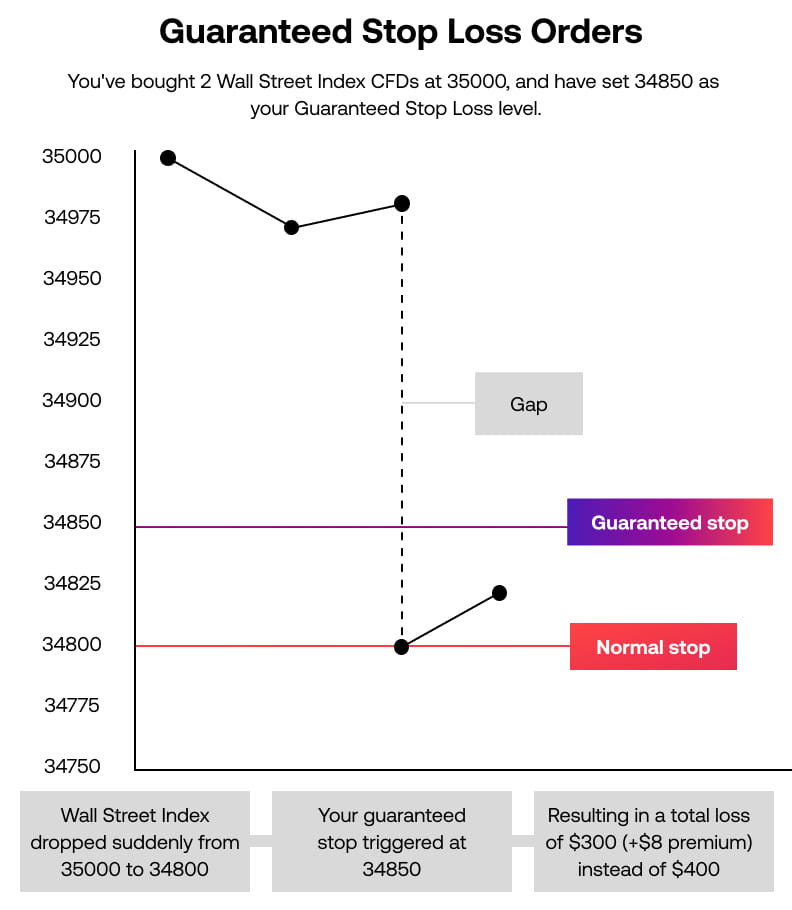

For the guaranteed stop loss order example below, imagine you had bought two Wall Street CFDs at 35000 and chosen 34850 as your maximum acceptable loss level, which is where you decide to place your Guaranteed Stop Loss. If triggered, this would equate to a $300 loss allowance ((35000 – 34850) x 2).

The GSLO premium for Wall Street is 4 x the quantity of CFDs or stake charged in the base currency of your account. In this case the premium is calculated as 4 x 2 = $8 and would be charged only if your GSLO was triggered.

Two days after you have placed your order, the price of the Wall Street Index suddenly drops lower from 35000 to 34800. With a GSLO in place, your trade has been closed out at the pre-determined level of 34850 for a total loss of $308 ($300 loss on your position + $8 premium on GSLO when triggered) preventing further loss as a result of market gapping.

If you had placed a normal stop loss on your position, your losses would have been far greater as you would only have been closed out at the next available price which was 34800.

(35000 – 34800) x2 = $400 total loss

Which markets do guaranteed stop loss orders cover?

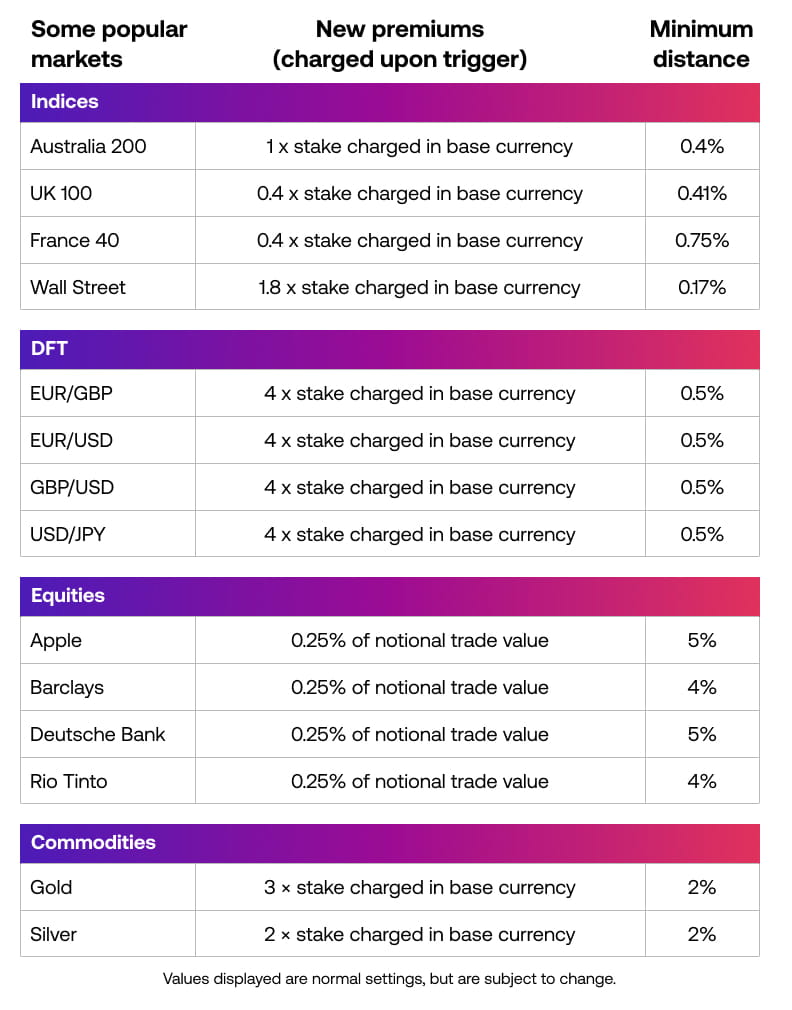

Below are some of the most heavily-traded markets at City Index which are now all covered by our GSLO functionality. You can view full GSLO details on individual markets by accessing the market information sheet in platform. The minimum distance required on our GSLO offering gives you more control to set your own acceptable levels of risk.

How much does a guaranteed stop loss order cost?

The trading cost of your guaranteed stop loss order is based on the size of the position you wish to cover. You will only pay a premium if your GSLO is triggered and this will appear on your next statement as a separate charge. The charge or premium you pay is calculated differently for different markets either as:

Number of points x quantity of your position (For example Indices like the UK 100)

OR

Percentage x notional trade value (Indices e.g. UK 100) (Equities e.g. Barclays)

As a guide, charges for the following popular markets are currently:

UK 100 CFD: 3x quantity of CFDs charged in base currency

EUR/USD (per 0.0001) DFT: 4 x stake charged in base currency

Barclays share CFD: 0.25% of notional trade value

US Crude Oil CFD: 4 x quantity of CFDs charged in base currency

How do I place a GSLO?

To place a guaranteed stop loss order on any market, open the deal ticket in platform and select the direction of the trade you would like to place, either Buy or Sell. Next, enter the quantity of your order. You can do this by entering a figure manually or by selecting a pre-determined quantity using the drop-down menu option.

To place your guaranteed stop loss order, open the Stop & Limits tab and select the Stop checkbox, then fill in the price and quantity to determine the level at which your position will close out. Remember to tick the guaranteed checkbox.

Further options in the deal ticket allow you to add a trailing stop and a limit on your order. Once you have filled in all of the information for your stop, click the Place Trade Button and your position will be opened with a GSLO attached.

Can I change my GSLO after making a trade?

Yes, you can change the level of a GSLO after placing a trade by opening your position and amending the price or quantity at which your guaranteed stop will be triggered. You will not be charged for amending a GSLO on an open trade.

Can I add a GSLO to an existing position?

If you have a current position that you would like to add a GSLO to, visit the open position tab in platform, open your trade and select the Stops & Limits section within the deal ticket then select the price and quantity at which you would like your Guaranteed Stop to be triggered. There is no additional charge for adding a GSLO to an open trade. Note: the market will need to be open for you to add a GSLO.

Can I cancel a GSLO?

Yes, you can cancel any guaranteed stop loss order on your account at any time, free of charge.