Spread betting on forex

-

Competitive spreads

Tight spreads from 0.5 points

-

Range of markets

Spread bet on 84+ global FX pairs

-

Award-winning

Best Spread Betting Provider 2021 - Shares Awards

Spread betting is our most popular way to trade FX. With City Index you get 24 hours trading on 80+ forex currency pairs.

-

Tax free trading

No UK stamp duty or Capital Gains Tax to pay*, and margins from just 3.33%. -

Market leading spreads

Spreads on major FX pairs from 0.5 points. -

Multiple ways to trade

Choice of daily funded trades, forwards and options, plus, trade on falling rates.

*Spread Betting is exempt from UK stamp duty and UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

*Spread Betting is exempt from UK stamp duty and UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

Live spread betting prices

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

City Index offers two popular ways to spread bet forex: Daily Funded Trades (DFTs) and forwards.

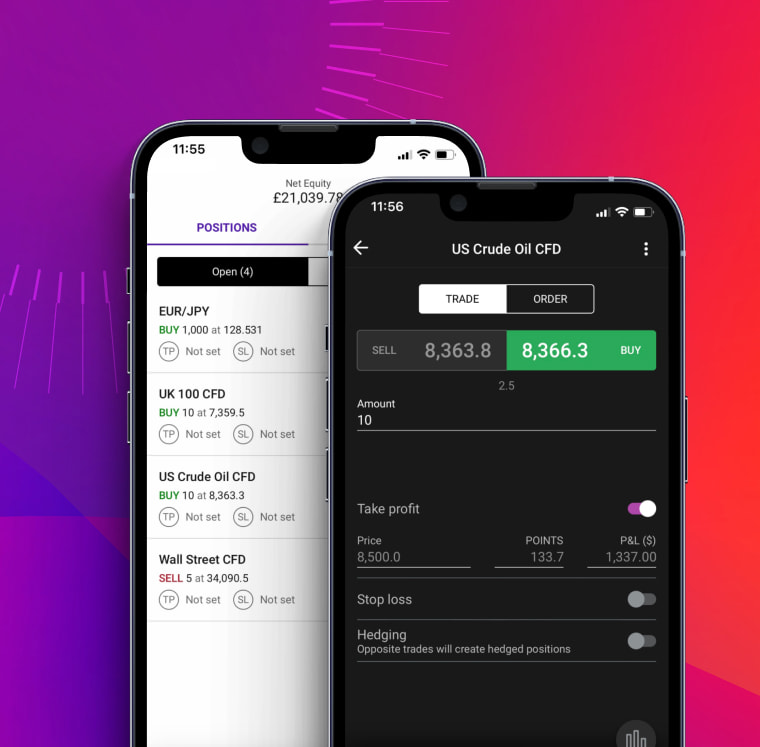

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Over one million account holders* use us to trade the financial markets. Here's why.

*StoneX retail trading live and demo accounts globally in the last 2 years.

Forex spread betting FAQ

How do you account for the spread in forex trading?

To account for the spread in forex trading, you simply need to include the difference between your chosen market’s buy and sell prices when calculating a trade’s outcome. In order for a trade to become profitable, you’ll need your FX pair to move beyond the price of the spread.

For instance, if EUR/USD is trading at 1.1348, it might have a sell price of 1.1347 and a buy price of 1.1349 – a spread of 2 points. To go long, you’d trade at the buy price of 1.1349, which means you’d need the sell price to move above 1.1349 before you can execute at profit.

If you close your trade when Eurodollar rises to 1.1402, with a spread of 1.1401/1.1402, you would sell at 1.1401 so your profit would be 52 points multiplied by your stake size.

Is spread betting good for forex day trading?

Spread betting is a popular way to day trade forex. Like traditional forex trading, spread betting gives you access to leverage and enables you to go short on FX pairs as well as long – but it comes with some additional powerful benefits.

Firstly, all profits from spread betting are entirely tax free in the UK.* You won’t have to pay any capital gains tax or income tax. Plus, spread bets are always in your base currency, so there’s no currency conversion required to trade global currencies.

Is forex trading classed as spread betting?

No, forex trading isn’t classed as spread betting. Forex trading is the buying and selling of currency pairs, spread betting is a derivative product that enables you to speculate on a range of different asset classes.

You can use spread betting to go long and short on forex pairs, but it works a little bit differently to spot FX trading. Instead of selling the quote currency to buy the base currency, you’re betting on the future price direction of the pair.

Say, for example, that you bet £5 per point that EUR/USD is going to rise from its current price of 1.1348. You’ll make £5 for every point that EUR/USD goes up and lose £5 for every point it falls.

You might notice a couple of differences to forex trading here. Chiefly, your profit or loss is calculated in GBP, not USD. That’s because you’re betting a set number of pounds per point, so you don’t have to worry about currency conversion.

If you have more questions visit the FAQ section or start a chat with our support.