Reviewed by Patrick Foot, Senior Financial Writer.

- What are the forex trading risks?

- How to practise forex trading risk-free

- How to manage risk in forex trading

- Stop-loss and take-profit orders

- Making a trading plan

- FAQ

Risk in forex trading is the same as risk in any other market. If your positions go against you, you may have to close them at a loss instead of a profit.

No trader gets it right 100% of the time, so learning how to manage and mitigate risk is a key part of achieving success. In this guide, we’re going to cover the forex trading risks you should be aware of, and how to keep them in check.

What are the risks of forex trading?

There are two main risk factors that come with forex trading: volatility and margin. Let’s examine what each is in turn, before we take a look at how to mitigate them.

1. Volatility

As we covered on the what is forex trading page, currency prices are constantly on the move due to the high liquidity of the foreign exchange markets.

High liquidity is usually a good thing – it makes it easier for you to find someone to trade with, so you can quickly get out of trades. But when it leads to high volatility, it means that markets can make big swings. These swings could work in your favour, or they could amplify your losses.

As with any market, greater potential profits come with greater risk. Highly volatile forex markets bring just that. They’re prized by some traders, but can hurt your bottom line if you’re not careful.

2. Leverage

Whether you decide to trade via spot forex, FX CFDs or spread betting on currencies, chances are you’ll use margin to open your positions. Without it, you might have to spend hundreds of thousands of dollars, pounds or euros whenever you want to trade.

Margin means you only need a fraction of your trade’s full value in your account to open a position. Many of City Index’s FX markets only require 3.33% or 5%. Your profit or loss, though, will still be based on the full value of your trade, which magnifies both your profits and your losses.

How to practise forex trading risk-free

There’s no such thing as a risk-free forex trading strategy, but you can practice buying and selling currencies with zero risk. A City Index demo account gives you £10,000 in virtual funds, and access to our full range of FX markets.

If you want to see how successful you’d be on live markets, it’s the perfect place to start.

How to manage risk in forex trading

There are lots of different strategies and tools you can use to limit your forex trading risk. Here, we’re going to explore two: using stops and making a trading plan.

Want to find out more about managing risk? Head over to the City Index Academy.

Stop losses and take profits

Stop losses and take profits are orders that tell your trading provider to close a position once it hits a certain level. Stops close it once it reaches a set amount of loss, take profits close it once it reaches a set level of profit.

You’ll also often see take profits referred to as ‘limits’.

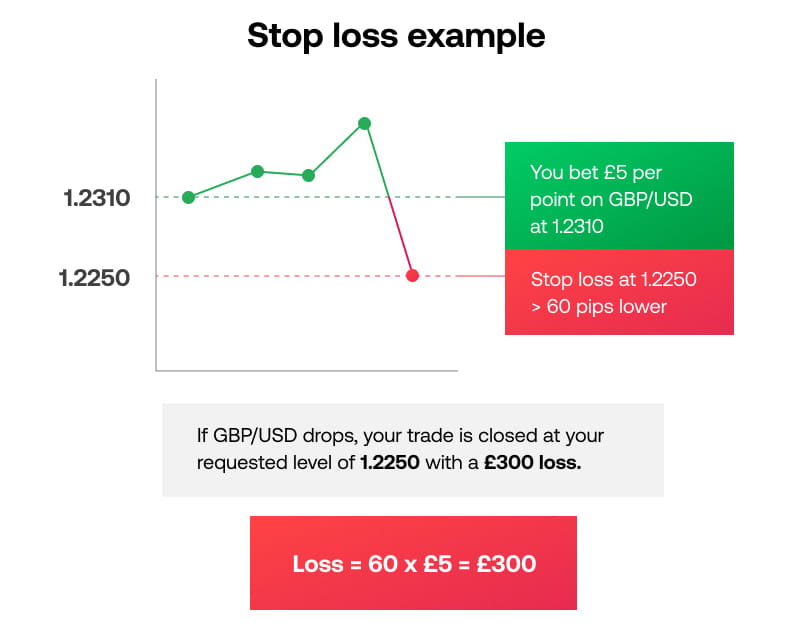

Stops provide a useful method of deciding your overall risk on any trade. For example, if you want to bet £5 per point on GBP/USD but only risk £300, you can use a stop.

Your cable position will make or lose you £5 for every pip that the pair moves, so if you place a stop 60 pips below the opening price of your trade, it will close the position if it hits a £300 loss.

Take profits, on the other hand, can help you set profit targets. If you’re aiming for a £900 profit from your GBP/USD trade, you can place a limit 180 pips above your opening price.

Tips for placing stops

1. Strike a balance

You might be tempted to set your stop as close to the market’s opening level as possible, to limit your potential losses from the trade. However, this will increase the likelihood of your stop being triggered.

Pay attention to current market conditions and try to strike a balance between giving the position room to move and risking too much capital.

2. You can move stops

Your position has moved in your favour, and you think it has further to run – but you’re worried about losing your profits if the market reverses. Instead of closing your trade, you could move your stop up to secure your profits now.

You can even set trailing stops. These will automatically follow your market if it moves in your favour. Then, if it turns, your stop remains in place.

3. Look for support or resistance levels

Applying technical analysis can be useful when deciding where to place your stops.

Say, for instance, that you’re considering selling EUR/USD at 1.1502. Looking at a EUR/USD chart, you notice that Eurodollar has previously moved up to 1.1540 multiple times but struggled to break beyond it.

If EUR/USD moves past 1.1540, a longer rally might be on the cards, so you know your planned short trade has failed. Place a stop just above 1.1540, and you won’t suffer any further losses.

Want to practise placing stops? Get started with a free City Index demo.

Creating a forex trading plan

Planning your strategy beforehand is crucial to limiting your risk. Otherwise, emotions can lead to bad habits in the heat of the markets.

Your trading plan should include how much to deposit into your account, and your accepted risk on each trade – including your risk/reward ratio.

Trade sizing is key to achieving this. If, for instance, you decide to risk 10% of your account on each position, then it will only take ten losing trades to clear your balance. Drop your risk to 2%, and that number goes up to 50.

Your risk/reward ratio, meanwhile, dictates which opportunities you trade, and which you skip. Essentially, you’re deciding how much potential profit you need in return for the capital you’re risking.

A ratio of 1:2 means that you target twice as much profit as loss. Set a stop loss 100 points away, and you’d want a take profit 200 points away.

You should make double the profit from successful positions as losing ones, which means you don’t have to be right more than 50% of the time to earn a profit.

Find out more about creating a forex trading plan.