Spread betting on commodities

-

Multiple markets

Choose from over 20 commodity markets, offered as cash or futures

-

Competitive pricing

Trade on tight spreads, and commission free

-

Capital gains tax

No UK Capital Gains Tax on any profits*

Spread betting is a popular way to trade commodities. City Index offers a wide range of 20+ energy, grain and soft commodities futures.

-

Diversify your portfolio

Add commodities markets to your portfolio to hedge against inflation and diversify your investments across asset classes. -

Range of markets

Trade 20+ global commodity markets including gold, silver, wheat and more. -

Trade on leverage

Speculate on dozens of commodity markets with margin from just 10% with City Index.

*Spread Betting is exempt from UK stamp duty and UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

*Spread Betting is exempt from UK stamp duty and UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

Live spread betting prices

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

Futures are ideal for longer-term trading.

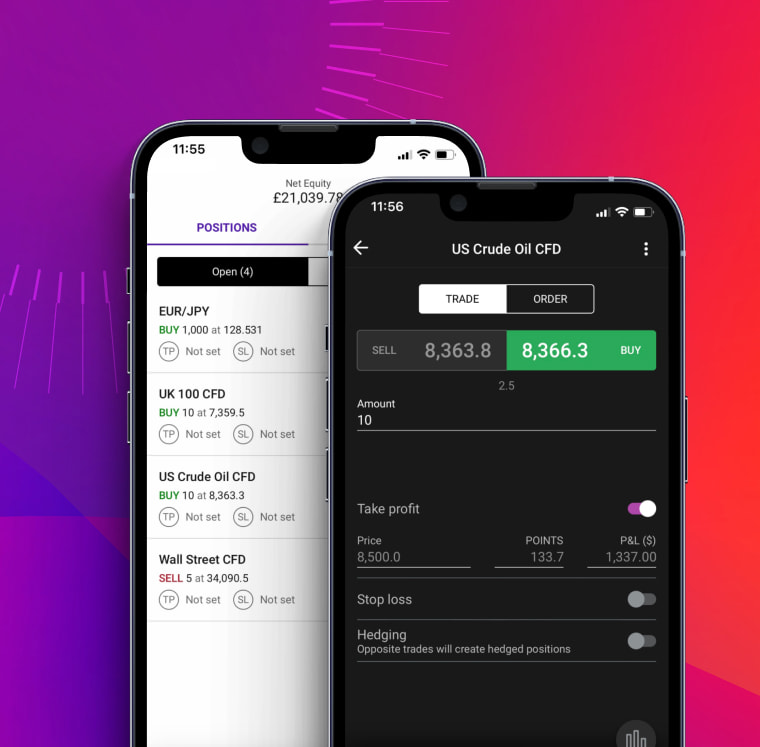

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Commodities spread betting FAQ

What is a spread in commodity trading?

A spread is the difference between the buy (bid) and sell (offer) prices quoted for a market. If you can buy gold at 1841 and sell it at 1840, for example, then gold has a one-point spread.

When you spread bet or trade CFDs on commodities, then the spread will include the cost you pay to open and close your position – so you won’t have to pay any commission on the trade.

How does spread betting on commodities work?

Spread betting on commodities works by enabling you to place a bet of a set number of pounds per point – known as your stake – on whether a commodity’s price is going to rise or fall. Then as your commodity moves, your stake will determine your profit or loss.

For every point it moves in your chosen direction, you’ll earn your stake as profit. But you’ll lose your stake for every point it moves against you. You’ll realise that profit or loss when you close your position.

Say, for example, that you bet £1 per point that gold is going to fall from its current price of $1,800.0. For every point that gold falls from 1,800.0, you’ll make £1. For each point it rises, you’ll lose £1.

A single point of gold movement is equal to $0.1 of movement in the precious metal’s price. So if gold falls to 1790.0, you’ll make £100. If it rises to 1,805.4, you’ll lose £54.

Do commodity day traders use spread betting?

Lots of commodity day traders use spread betting to buy and sell a range of commodities alongside stocks, indices, forex and more. Spread betting brings lots of benefits for day traders, including leverage to make capital go further and the ability to go short.

You can even trade on the spot prices of commodities using our non-expiring commodity spot markets, and since day traders never keep a position open overnight you’ll never have to pay overnight financing.

However, using leverage and shorting will increase your potential losses, so a solid risk management plan is essential.

If you have more questions visit the FAQ section or start a chat with our support.