CFD trading on commodities

-

Wide range of markets

Trade on over 20 global markets as cash or futures

-

Go long or short

Profit from falling as well as rising prices on precious metals

-

Safe-haven assets

Hedge against falling indices and periods of market turbulence

CFD trading is a popular way to trade commodities. City Index offers a wide range of 20+ energy, grain and soft commodities futures.

-

Diversify your portfolio

Add commodities markets to your portfolio to hedge against inflation and diversify your investments across asset classes. -

Trade on leverage

Take advantage of leveraged trading to speculate on precious metals with no need to own the underlying asset. -

Choice of markets

Trade commodities as futures, cash, options and spot markets with a market-leading provider.

*CFD Trading is exempt from UK stamp duty. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

*CFD Trading is exempt from UK stamp duty. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

Real-time pricing

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

Futures are ideal for longer-term trading.

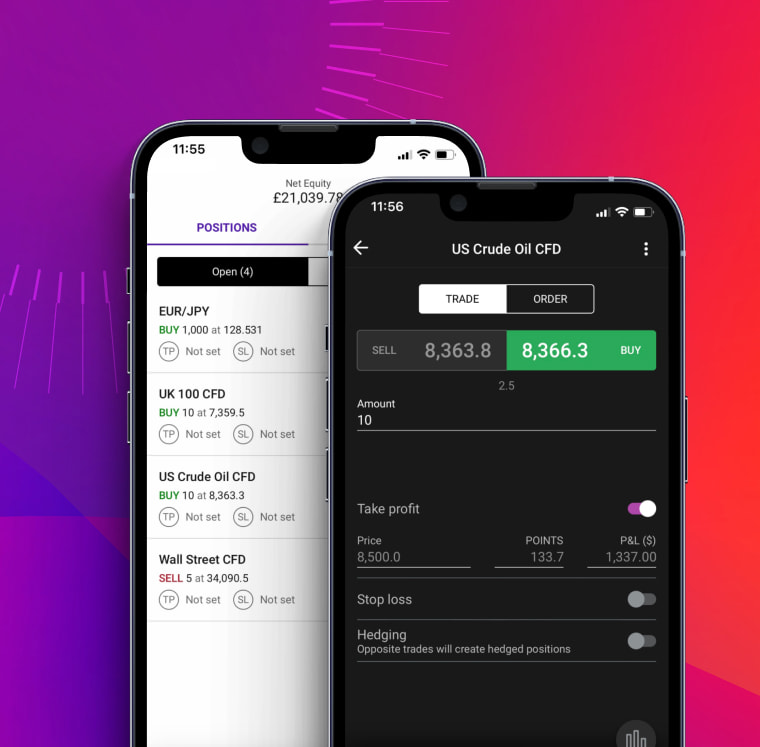

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Commodities CFD trading FAQ

How do you trade commodities with CFDs?

To trade commodities with CFDs, you’ll first of all need to learn how commodity CFDs work. Then, you can open a CFD account and use it to buy and sell oil, gold, silver and more.

Commodity CFDs work using contracts that track the live prices of commodity markets. Buying or selling one of these contracts is equivalent to trading a standard amount of the underlying commodity it tracks – and gives you the same exposure as trading the commodity in the open market.

However, you’ll never actually own the commodity or future that you’re trading, so you don’t need to worry about taking delivery or storage.

A City Index account enables you to trade our full range of commodity markets alongside indices, shares, forex and more. Open your trading account here.

What are the main drivers of commodity prices?

As with any financial market, commodity prices are driven by the laws of supply and demand. However, each commodity is different. The supply of oil is very different to that of gold, for example – and the same is true for its demand.

Oil is drilled around the world, then refined and transported in tankers, oil pipelines and more. Global supply can be fragile, with natural disasters or international conflict often seeing its price spike.

Demand, meanwhile, is driven by world industry. When the economy is growing, oil demand tends to rise. When the economy stalls, oil’s price might fall.

Gold is mined around the world, but unlike oil is very rarely consumed – so gold supply is constantly rising. Overall, the precious metal’s supply is less fragile than that of energy markets.

Its demand picture, too, is unique. Gold is prized for its ability to hold value and is stored by lots of central banks around the world. When volatility peaks, investors may try to buy gold as a ‘safe haven’, causing its price to rise.

Learn more about what drives gold and oil prices.

What are the most-traded commodities?

The most-traded commodities tend to be gold, silver and oil. Gold is often used by traders as a hedge against volatility, as it’s seen to hold its value when other markets go awry. And as the resource that powers the global economy, oil markets can see some powerful volatility.

Here are the five top-traded commodity markets on the City Index platform:

- Gold

- Silver

- US crude oil

- UK crude oil

- Carbon emissions

Which way will they head next? Log in to take your position.

If you have more questions visit the FAQ section or start a chat with our support.