Reviewed by Patrick Foot, Senior Financial Writer.

- What is leverage in CFD trading?

- Benefits of leverage

- CFD leverage example

- What is CFD margin?

- Calculating margin

- The costs of leverage in CFDs

- How to manage CFD risks

What is leverage in CFD trading?

In CFD trading, leverage is the ability to trade without paying for the full value of your position upfront. Instead, you only have to pay a deposit called your margin.

While leverage is a powerful benefit, it will also increase your risk. So, before you start trading on margin, it’s a good idea to learn how it works – and how to manage risk using stop losses.

Want an introduction to CFDs? Take a look at the what is CFD trading page.

How leverage works in CFDs

Leverage works in CFDs because you never own the asset you’re buying and selling. You’re only speculating on price movements, which means you don’t have to pay for the full value of your chosen asset outright.

Say, for example, that you want to trade 10 US SP 500 CFDs when the S&P 500 is at 4,500. The full value of your position is (10 * 4,500) $45,000, but you won’t need that much in your account to execute your trade. You'll just need to ensure you have enough funds in your account to cover your margin requirement.

Your profit or loss, though, will still be based on the full $45,000. You’ll make $10 for every point that the S&P moves up, and lose $10 for every point it moves down.

Benefits of leverage

Trading on leverage means you can gain the same amount of market exposure by depositing just a small fraction of the total value of your trade. This can be useful to CFD traders because it means that they can put their money to use elsewhere.

In our example above, you might only have to pay 5% of $45,000, or $2,250, to open your position.

Another key benefit of leverage is that it helps magnify your returns, which is great news if the market moves in the direction that you expect. However, this comes with the downside that leverage will also magnify your losses – in exactly the same way as your gains.

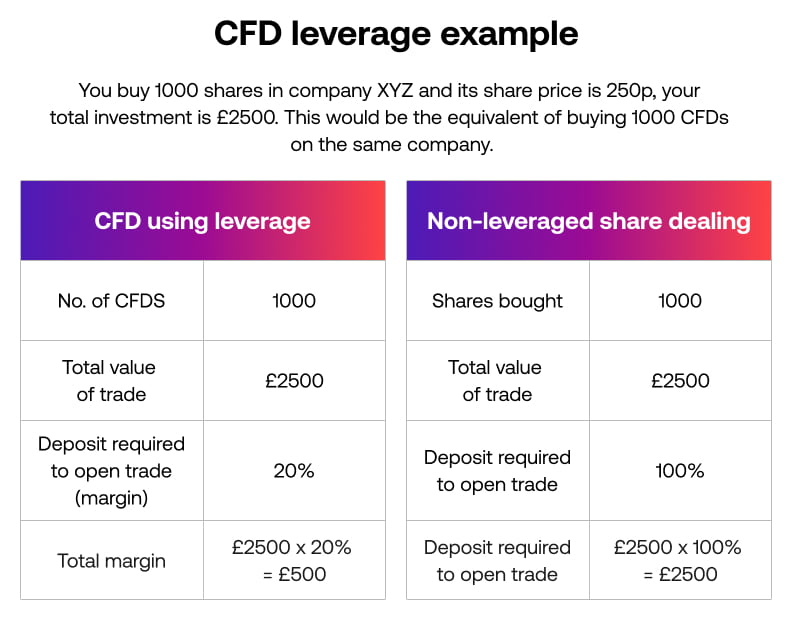

CFD leverage example: share dealing vs CFDs

To see how leveraged CFDs work in practice, let’s take a look at an example.

You want to trade 1000 shares in company XYZ, which has a current share price of 250p. You could invest in XYZ using share dealing, or you could buy 1,000 XYZ CFDs.

Either way, the total size of your position would be (250p * 1000) £2,500.

XYZ’s margin requirement is 20%. So by using CFDs, you only have to deposit £500 to execute your trade rather than £2500 using non-leveraged share dealing.

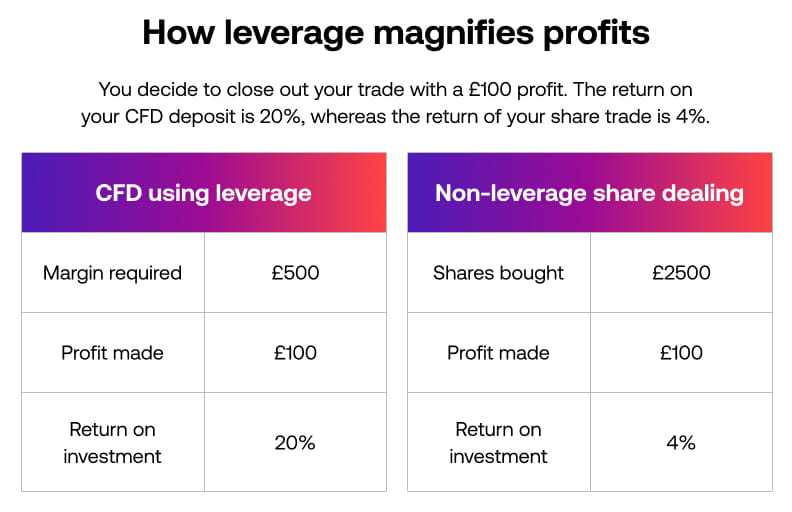

How leverage can magnify profits

Now let’s say that company XYZ’s share price rallies after strong earnings, increasing to 260p – so you decide to close out your trade.

With both share dealing and CFD trading, you would have made a return of (260p-250p * 1,000) £100. However, the return on your CFD would be 20%, compared to just 4% on your investment.

Why? Because you only deposited £500 to open the CFD position.

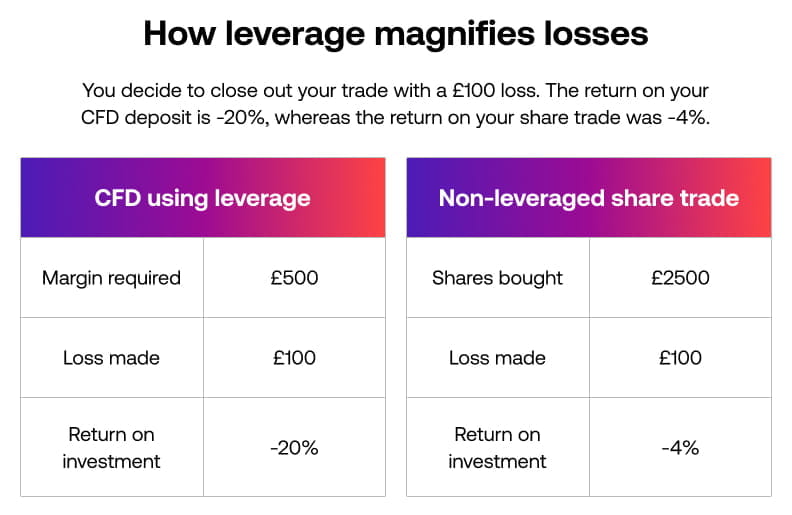

How leverage can magnify losses

That’s how leverage works with a profitable position – but the same will apply if you close out at a loss.

Suppose your trade on XYZ was unsuccessful and you decide to close with a £100 loss. In this scenario, the return on your CFD deposit would be -20%, because you’ve lost £100 when you deposited £500.

The return on your share trade, meanwhile, would be -4%. Using leverage has magnified your losses.

What is CFD margin?

CFD margin is the deposit that you’ll need to have in your account to trade a contract for difference. You’ll also see it referred to as a market’s margin factor or margin requirement.

Margin factors vary across markets, and are always given as a percentage. The percentage tells you how much of your position’s full value you’ll need to deposit. Generally speaking, the higher the requirement, the more volatile or illiquid the market.

To see the margin requirement for any City Index market, head over to the ‘Market 360’ tab on your trading platform.

Margin calls and close out levels

To keep a leveraged trade open, you’ll need to ensure that you have the required funds in your account to cover your margin at all times – especially if your position makes a loss.

Say, for instance, that you’ve only deposited the required £500 to buy your XYZ CFDs. If XYZ’s share price drops and your position sits at -£50, then you’ll only have £450 equity in your account, which isn’t enough to cover your margin requirement.

This situation is called a margin call, and means your position is at risk of being closed. City Index closes out positions after funds have dropped below 50% of the trade's margin requirement.

To avoid margin calls, you should always ensure you have sufficient funds in your account.

How do I calculate my required margin?

To calculate your required margin on any position, you need to know its total size and margin requirement. Let’s say, for example, that you want to buy 25 UK 100 CFDs at 7,500 and the UK 100 has a margin factor of 5%:

- The total size of your position is (25 * 7,500) £187,500

- 5% of 187,500 is £9,375

- You need £9,375 in your account as margin

However, you don’t need to calculate any of this manually – whenever you open a position in the City Index platform, you’ll see how much you’ll need in your account displayed on the deal ticket.

Keeping positions open

When you have multiple positions open at once, keeping track of your total margin requirement can be tricky. But again, you don’t need to calculate anything yourself. Instead, you can use the Margin Indicator on the City Index platform.

The Margin Indicator is always displayed at the top of the City Index platform, or in the dropdown from the top of the mobile app. It tells you how much equity you have in your account, compared to your total margin requirement.

- If the indicator is greater than 100%, then you have the funds required to keep your positions open

- If it falls below 100%, you are at risk of your trade falling further and automatically being closed out

- Should it fall below 50%, you no longer have enough funds in your account to cover your total margin and positions will be automatically closed out

A warning symbol will be displayed next to the indicator if it drops below 80%

What should you do if you are on margin call?

If you are on margin call, you have three potential options:

- Close out your trade, realise the loss and reduce your overall margin requirement

- Reduce the size of your positions to free up some equity in your account

- Add additional funds to your account. You’ll need to cover the shortfall in margin, and may want to consider additional funds to sustain any further losses

The costs of leveraged trading

There are costs you'll have to pay to cover a leveraged CFD trade including overnight financing.

When you trade on leverage, your provider is essentially lending you the funds to cover the full size of your position. Overnight financing is the cost of keeping this loan open for more than a single trading day.

Find out more about the costs of CFD trading.

Three ways to manage CFD risks

1. Use margin sensibly

It’s usually a good idea to be prudent when sizing CFD positions, instead of using up all the free equity in your account as margin. As we’ve already covered, you could quickly find yourself on a margin call otherwise.

Many traders limit themselves to only risking 1% or 2% of their total funds on an individual opportunity. That way, you can sustain multiple losses without running the risk of a margin call.

2. Use stop losses

Stop-loss orders will automatically close out a trade if it hits a certain level of loss – which can help limit your risk on any given position. You can add them via the deal ticket, or to an existing trade.

When placing a stop-loss order, it is important to note that the price at which your position is closed could be different from where you placed your stop, if the market gaps. Gaps occur when there is significant market volatility and prices change rapidly, meaning that closing prices can differ from the trigger prices that have been set.

To remove the risk of gaps negatively affecting your stops, you can use a guaranteed stop loss. These will always trigger at the price you set, even in highly volatile markets. If a guaranteed stop is triggered, you’ll pay a small premium.

3. Use CFDs to hedge

As CFDs allow you to short sell and potentially profit from falling market prices, they are sometimes used as a hedging tool by investors as 'insurance' to offset losses made in their portfolios.

For example, if you have a long-term portfolio, but feel that there is a short-term risk to the value of your investments, you could use CFDs to mitigate a short-term loss by 'hedging' your position.

This way, if the value of your portfolio does fall, the profit in the CFDs would help you offset these losses, enabling you to retain your portfolio without incurring any significant loss to its overall value.