Bonds trading

-

Competitive pricing

Trade bond markets from just 0.02pts

-

Range of markets

Speculate on UK Long Gilt, US T-note and Euro Bund markets

-

Go long or short

Profit from both rising and falling bonds

Bonds explained

-

No commissions

Trade bonds commission-free and trade with margin from just 20% on bonds markets. -

Trade on leverage

Take advantage of leveraged trading products to speculate on the future price of bonds. -

Diversify your portfolio

Trading on price movements in bonds allows you to diversify your investment portfolio.

Bonds news and analysis

Latest research

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

Ways to trade bonds

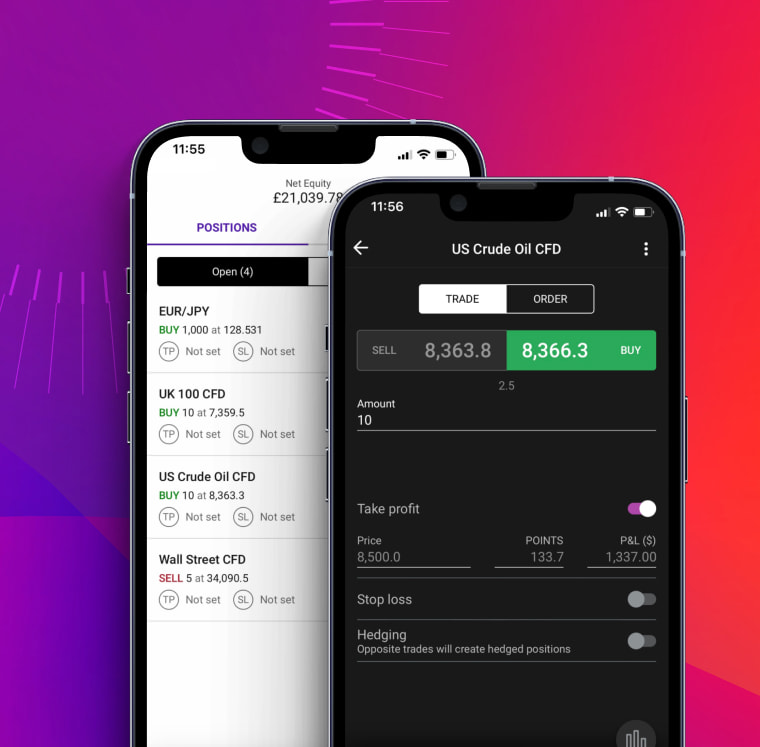

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Bonds trading FAQ

How does trading bonds work?

Trading bonds with CFDs and spread betting works just like trading any other market – except that instead of trading on the prices of stocks, forex pairs or indices, you’re trading on the prices of government bonds.

When you buy or sell a bond CFD, you’re agreeing to exchange the difference in the bond’s price from when you opened your position to when you close it. When you spread bet on a bond, you’re betting on whether its price is headed next.

With either, you can open long or short positions to capitalise on any market movement.

What are the types of bonds?

There are two main types of bonds: corporate and government. As the names suggest, corporate bonds are sold by companies and government bonds are sold by countries. There are other categories – such as municipal bonds and agency bonds – but these are the most common.

In general, corporate bonds are seen as the riskier option as it is more likely that a company will default on its loans than a country. However, government bonds can also be risky, so it’s always worth checking the credit rating of the market you’re planning on trading.

What should you know before investing in bonds?

Before you invest in bonds, you’ll want to make sure you fully understand how the bond market works, and the key information for your chosen investment – including its coupon rate, when it matures and its credit rating.

It’s also worth checking current interest rates, and guidance on where rates might head next, to ensure that your bond is a good investment. Remember, bonds involve lending your capital to a government or company until a set date that may be in the long-term future – so it’s worth doing your homework now.

With City Index, you can trade on bond prices over the short term instead of investing in them directly. Learn more about how bond trading works.

If you have more questions visit the FAQ section or start a chat with our support.