Spread betting

Spread betting with City Index provides a tax-free* way to trade on thousands of financial markets.

- A global Spread Betting provider for 40 years

- Tight spreads, zero commissions

- No tax on profits or stamp duty*

- Now available on TradingView

- A global Spread Betting provider for 40 years

- Tight spreads, zero commissions

- No tax on profits or stamp duty*

- Now available on TradingView

Award-winning provider

Why spread bet with City Index?

-

Competitive, fixed spreads

Stay in control of your trading with transparent pricing and fast execution.

-

Tax-efficient trading

Pay no UK capital gains tax or stamp duty when you spread bet with us.*

-

Award-winning platforms

Winner of Best Trading Platform 2022 – Online Money Awards and Best Trading App 2021 – Professional Trader Awards.

-

8,500+ markets

Trade on FX, indices, shares and more – with zero commission to pay.

*Spread Betting is exempt from UK stamp duty and UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

Learn about spread betting

What is spread betting?

How to spread bet

Spread betting risk management

Margin and leverage in spread betting

Get access to 8,500+ spread betting markets from one account

Our key figures

*StoneX retail trading live and demo accounts globally in the last 2 years.

See our spread betting costs

*For non-US equities, minimum spread is 10 bps either side of the underlying market spread. For US equities, minimum spread is 1.5c either side of the market spread.

There’s no commission to pay when you spread bet. Instead, all the costs to open and close your position are covered in the difference between the buy and sell prices (known as the spread). If you keep a daily funded bet open overnight, you’ll pay overnight funding.

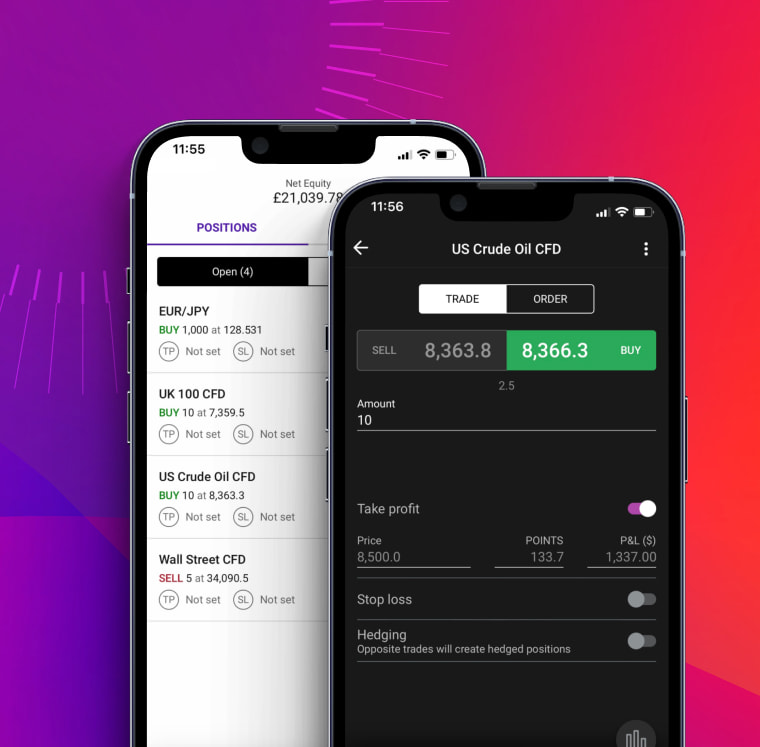

Trade wherever you are, on our fast, reliable platforms

Customisable charts

16 chart types with 80+ indicators designed to help you pinpoint your next opportunity.

Award-winning platform

Our intuitive technology is designed to suit traders of all levels.

Actionable trade ideas

Our research portal highlights trade ideas using fundamental and technical analysis.

Insightful data

Receive all the latest market news and expert commentary direct from Reuters in-app.

Open an account with the best spread betting provider*

-

Applyfor an account

-

Fundusing card or bank transfer

-

Tradeon powerful platforms

Open an account with the best spread betting provider*

More about spread betting

Spread betting FAQ

Is spread betting good for beginners?

If you’re entirely new to the markets, then we wouldn’t recommend leaping straight into spread betting with a live account. We have lots of resources to make sure you’re fully equipped before risking any real capital: including the City Index Academy and a free trading demo.

What does the spread mean in trading?

In trading, the spread is the difference between the buy and sell prices quoted on a market. For instance, if the DAX has a buy price of 15,904 and a sell price of 15,900, then it has a four-point spread.

On spread betting markets, the spread also contains the cost to open and close positions. Instead of paying commission when you trade, your costs are covered by the spread.

How does spread betting work?

Spread betting works by enabling you to bet on the future direction of a market. As the market moves in your chosen direction, your bet will earn a profit. If the market moves against you, your bet will earn a loss.

Say, for example, that you bet £5 per point that the FTSE 100 will rise. For every point that the FTSE goes up, your trade will make £5. For every point it falls, you’ll lose £5.

You only realise any profit or loss when you close the position. If the FTSE has moved up 100 points when you close, your profit will make you (£5 * 100 points) £500. If it has moved down 100 points, you’ll lose £500 instead.

If you have more questions visit the FAQ section or start a chat with our support.