Reviewed by Patrick Foot, Senior Financial Writer.

Learn how to start trading forex in six steps, or jump ahead to a section:

-

You select between a wide range of FX markets, from majors such as EUR/USD to exotics like USD/TRY.

-

Decide how you want to trade forex

Do you want to trade on the spot market, or use forex futures?

-

Open and fund your forex account

To trade FX, you’ll need an account with a provider – and you’ll need to add some funds so you can open positions.

-

Decide to buy or sell your currency

With FX trading, you can go short as well as long, and earn a profit if you think your chosen pair will fall in price.

-

A comprehensive risk management strategy is your best tool when trading the currency markets.

-

Finally, it’s time to close your position and calculate your total profit or loss.

1. Choose a currency pair

The first step to opening a forex trade is to decide which currency pair you wish to trade. There are over 80 to choose from with City Index.

Forex pair categories

There are three main categories of forex pair:

- Majors consist of the world’s biggest currencies against the US dollar and make up around 85% of forex trading volume. The majors are EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF and USD/CAD

- Minors are all the other combinations of the world’s biggest currencies, such as EUR/GBP and AUD/JPY. These are also often referred to as major cross pairs

- Exotics are pairs that include less-traded currencies, such as the Turkish lira (TRY) or Mexican peso (MXN)

Most new traders will pick one or two major pairs to focus on, often starting out with euro-dollar (EUR/USD). This is the world’s most traded currency pair, and typically has the tightest spreads. But there are plenty of other popular FX pairs to trade - including USD/JPY USD/GBP AUD/USD.

2. Decide how you want to trade forex

There are two main types of forex markets: spot and futures.

- The spot market gives the live price of a forex pair, if you were buying or selling the currencies immediately

- The futures market is based on what the future value of a pair might be. The price is derived from futures contracts, in which traders agree to buy or sell a currency pair at a set price on a certain date in the future

With City Index, you can trade spot FX CFDs, and spread bet on futures and spot prices. Both methods enable you to go long and short on currency pairs, but they work in slightly different ways.

What are spot FX CFDs?

When you trade currencies at the spot price – for instance by buying US dollars and selling euros – you’d open your trade by deciding how much of the base currency you want to buy or sell.

But with City Index, you’ll trade spot FX via contracts for difference, or CFDs. You’ll never actually take ownership of the currencies themselves but will instead speculate on whether the spot price will rise or fall. For example, if you go long on EUR/GBP and the price of the underlying pair rises, the value of the CFD position will increase too.

Your profit or loss is determined by the difference between the closing and opening values of the forex contract. These traders do not have a pre-defined maturity date and are therefore only closed manually.

What is forex spread betting?

Forex spread betting involves speculating on whether the market price will rise or fall. As with CFDs, you won’t be buying or selling the underlying currencies, you’re trading a market that tracks the price of a forex pair. We offer trading on both spot and futures prices via spread bets.

In our platform, spot price spread bets are labelled as DFT (daily funded trades) while futures follow the standard naming conventions for futures contracts. For example, an AUD/USD future expiring on September 23 would be AUD/USD (per 0.0001) Sep 23 Spread.

When spread betting though, you place a bet of pounds per point of movement in the underlying currency. So, if you thought AUD/USD futures prices would fall before Sep 23, you’d go short and if they did fall, your profit would be determined by how much the market fell by.

![]()

FX trade types (EUR/USD)

| Spread betting | Spot FX | |

|---|---|---|

| Stake size | £'s per point | One lot |

| Profit / loss shown in | Pounds sterling | Quote currency |

| Example (EUR/USD) | £1 per point | $ profit/loss |

| Trade with profit | £1 profit for every point the trade moves in your favour | $1 profit for every point the trade moves in your favour |

| Trade with loss | £1 loss for every point the trade moves against you | $1 loss for every point the trade moves against you |

3. Open and fund your forex account

Before you can start trading forex, you’ll need to open a forex account with a trading provider.

You can open a live trading account with City Index in just a few minutes (application subject to review and approval). Then, all you need to do is add some funds and you’ll be all set to get started.

There are no minimum deposits with City Index accounts, but we recommend that you deposit at least £100 or an amount which is enough to cover the margin requirement of your first trade.

To calculate the amount of funds required to cover the margin requirement when you open a trade, simply multiply the total notional value of your trade (stake x price of the instrument) by the margin factor.

With City Index, you can calculate your margin automatically before placing a trade with the margin calculator.

You’ll also need to have enough capital in your FX account to cover any significant moves against your position, this is known as the maintenance margin. If the balance of your account falls below this level, you could end up on margin call and your positions could be closed.

You’ll be able to monitor and review your account’s total margin requirement through the “margin level indicator” in our platform.

Once funds have been credited to your account, you will see them available on your trading account and can start trading straight away.

If you don’t feel ready to commit real capital, you can open a demo forex trading account to try things out with zero risk of capital loss. A City Index demo gives you £10,000 in virtual funds to buy and sell our full range of markets. All the price movements are real, the only part that isn’t is the money involved. So, it’s a great place to practise or refine your trading strategy.

4. Decide to buy or sell your currency

Now you know which currency you’re trading – and how you want to trade it – it’s time to decide whether to go long or short.

All forex is quoted in terms of one currency versus another. As we’ve covered, each currency pair has a ‘base’ currency and a ‘quote’ currency. The base currency is the currency on the left of the currency pair and the quote currency is on the right. Essentially, when trading foreign currencies, you:

You would BUY a currency pair if you believe that the base currency will strengthen against the quote currency, or the quote currency will weaken against the base currency.

- This is a long position, so your profits will rise if the currency pair’s value rises

- However, for every point the pair falls below your open level, you will incur a loss

Alternatively, you would SELL a currency pair if you believe that the value of the currency pair will decrease – meaning the base currency will weaken in value against the quote currency, or the quote currency will strengthen against the base currency.

- This is a short position, so your profits will rise if the pair’s price falls

- However, for every point the pair rises above your open level, you will incur a loss

5. Monitor and manage your risk

Forex risk management is crucial for efficient trading – and a key element of risk management is the use of orders.

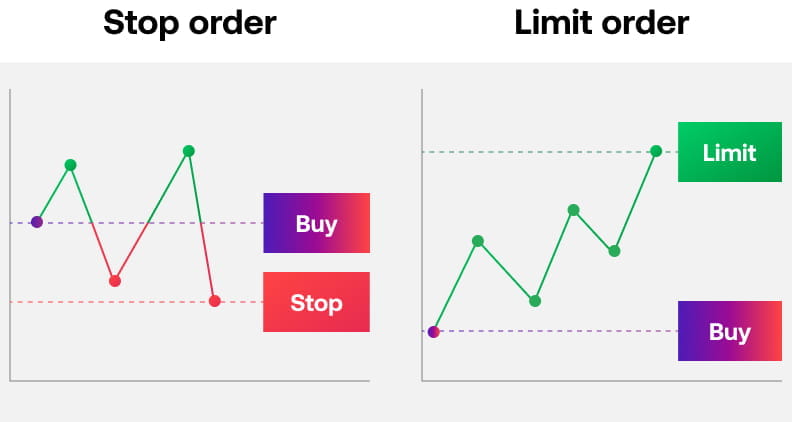

There are two main types of order: stop loss orders and take profit orders (sometimes called a limit order). Both act as instructions to automatically close a position when its price reaches a specific level predetermined by you.

Also read our forex trading tips guide.

What is a stop loss order?

A stop -loss order is an instruction to close out a trade at a price worse than the current market level and, as the name suggests, is used to help minimise losses. There are three types of stop-loss orders: standard, trailing and guaranteed.

A standard stop-loss order, once triggered, closes the trade at the best available price. There is a risk therefore that the closing price could be different from the order level if market prices gap.

A guaranteed stop loss, however, will close your trade at the stop loss level you have determined, regardless of any market gapping. They’re free to attach but there is a small premium is charged if triggered.

What is a limit order?

A limit order (or take profit) is an instruction to close out a trade at a price that is better than the current market level and is used to help lock in price targets.

Standard stop losses and limit orders are free to place and can be implemented in the dealing ticket when you first place your trade, and you can also attach orders to existing open positions.

6. Monitor and close your trade

Once open, your trade’s profit and loss will fluctuate as the market’s price moves.

You can track market prices, see your unrealised profit/loss update in real time, attach orders to open positions and add new trades or close existing trades from your computer or smartphone.

When you are ready to close your trade, you do the opposite to the opening trade. If you bought three CFDs to open, you would sell three CFDs to close. By closing the trade, your net open profit and loss will be realised and immediately reflected in your account cash balance.

Please note that City Index Spread Betting and CFD accounts are FIFO. To read more about this please visit our help and support section.

Realising your forex profit or loss

Your net open profit and loss will be realised as soon as you close your FX trade and will be reflected in your account cash balance. Your P&L will also automatically be converted to your account’s chosen base currency.

If you want to calculate your potential profit or loss ahead of time to understand your forex trading risk, our deal ticket automatically shows you P&L figures when you set stop-losses and take-profits in our platform.