CFD trading

CFD trading with City Index gives you access to over 5,000 global markets including indices, shares, commodities and bonds.

- A global Spread Betting provider for 40 years

- Competitive pricing

- Choice of 5,000+ CFDs from one account

- Best CFD Provider at ADVFN International Financial Awards 2023

- No stamp duty*

- A global Spread Betting provider for 40 years

- Competitive pricing

- Choice of 5,000+ CFDs from one account

- Best CFD Provider at ADVFN International Financial Awards 2023

- No stamp duty*

Award-winning provider

Why trade CFDs with City Index?

-

Lowering the cost of trading

Competitive pricing across every asset class, plus free live market data and no hidden fees.

-

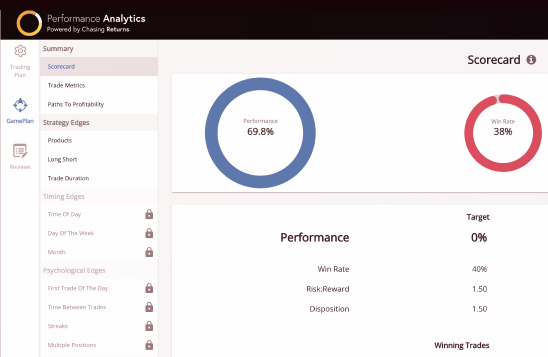

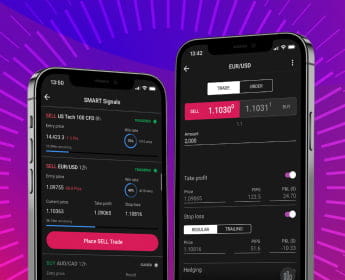

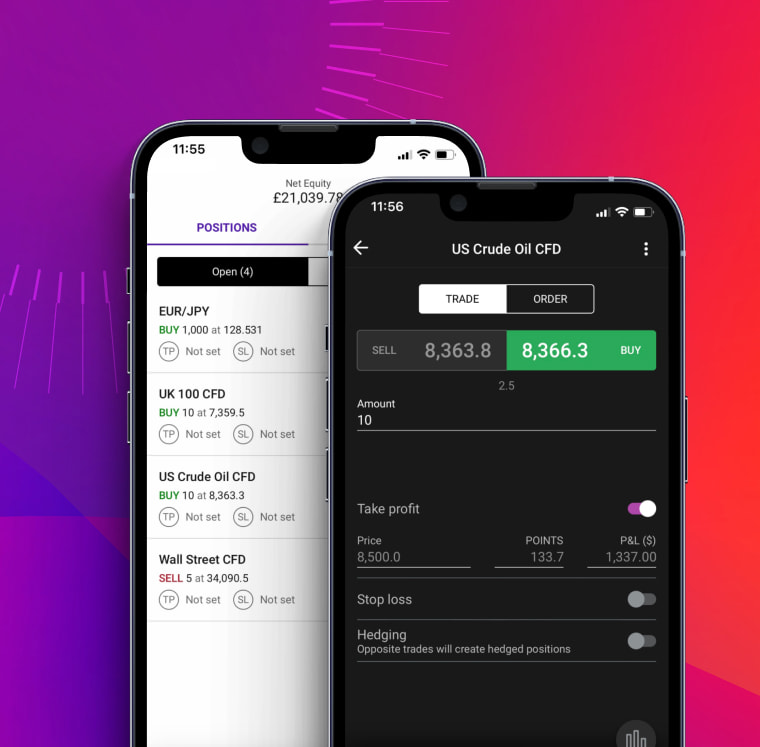

Advanced trading platforms

Trade on your browser or smartphone, and access exclusive tools including Performance Analytics and SMART Signals.

-

Extended market hours

Find and execute more opportunities with out-of-hours trading on indices and share CFDs.

-

Award-winning

Winner of Best CFD Provider - ADVFN International Financial Awards 2023 and Best Trading Platform 2023 – Online Money Awards.

*Spread Betting is exempt from UK stamp duty and UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

Learn about CFD trading

What is CFD trading?

How to trade CFDs?

- 1. Choose a CFD market

- 2. Decide to buy or sell

- 3. Select your trade size

- 4. Add a stop loss

- 5. Monitor and close your trade

Costs of CFD trading

CFD margin and leverage

Get access to 5,000+ CFD markets from one account

See our CFD trading costs

When you buy and sell share CFDs, you’ll pay commission. With every other CFD market we offer, though, there’s no commission to pay – all the costs to open and close your position are covered in the spread. You’ll pay an overnight funding charge if you keep a daily CFD open overnight.

Our key figures

*StoneX retail trading live and demo accounts globally in the last 2 years.

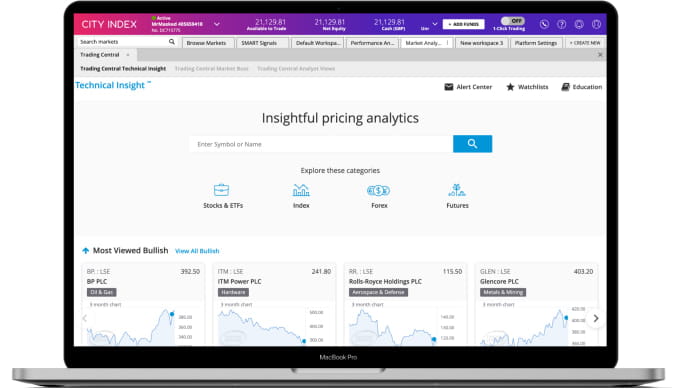

Trade wherever you are, on our fast, reliable platforms

Customisable charts

16 chart types with 80+ indicators designed to help you pinpoint your next opportunity.

Award-winning platform

Our intuitive technology is designed to suit traders of all levels.

Actionable trade ideas

Our research portal highlights trade ideas using fundamental and technical analysis.

Insightful data

Receive all the latest market news and expert commentary direct from Reuters in-app.

Powerful tools

Open an account with the best CFD provider*

-

Applyfor an account

-

Fundusing card or bank transfer

-

Tradeon powerful platforms

Open an account with the best CFD provider*

CFD trading FAQ

Do I pay stamp duty on CFD profits in the UK?

As CFDs are a derivative product, you don't actually own the underlying instrument that you are trading on. This means that you do not have to pay UK stamp duty, saving you the stamp duty charge associated with regular share dealing*.

*CFD trading is exempt from UK stamp duty. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

How do CFDs work?

CFDs work using contracts that track the live prices of financial markets. When you trade one of these contracts, you’ll exchange the difference in the market’s price from when you open your position to when you close it. You can buy CFDs to open a long position or sell them to go short.

For example, say you buy a FTSE CFD when the index is at 7100, then sell it at 7200. You’ll exchange the difference between 7100 and 7200, pocketing 100 points as profit. If the FTSE fell to 7000 instead, though, you’d lose 100 points.

Your total profit or loss is dictated by the number of contracts you buy or sell.

How does CFD margin work?

CFD margin works by only requiring you to hold a fraction of a trade’s total value in your account in order to open and maintain your position. However, your final profit and loss will still be based on the full size of your trade.

Trading £1000 of Barclays stock with CFDs, for example, might only require you to have £200 in your account as margin. But if that stock then increases to a value of £1100, you’ll make the full £100 as profit – the same as if you’d paid the full £1000. If the stock falls to £900, you still lose £100.

Essentially, in this example you’d have made £100 profit from an initial outlay of just £200, a gain of 50%. Without CFDs, you’d still have made £100, but you’d have paid £1000. Your gain would only be 10%, meaning the CFD margin has magnified your profits.

However, exactly the same effect applies to losses – which is why risk management is a key part of CFD trading.

How do you calculate CFD profits?

To calculate CFD profits, you multiply the number of CFDs you have traded by the point value of each CFD – and multiply that figure by the number of points the underlying market has moved from when you opened your trade to when you close it.

If the underling market has moved in your chosen direction, you earn that figure as profit. If not, you make a loss.

That might sound complicated, but it becomes much simpler in an example.

Buying a single FTSE CFD will earn you £1 for every point the index rises and lose you £1 for every point it falls, which means a FTSE CFD has a point value of £1. Buy 10 FTSE CFDs, and you’ll make £10 for every point the index rises – but lose £10 for each point it falls.

If the FTSE moves from 7100 to 7200, then it has moved 100 points. You’ve bought CFDs, so you profit if the index moves up, meaning your 10 CFDs make you a profit of (100 points * £10 point value) £1000.

If you’d sold 10 CFDs instead, you’d make the same figure (£1000) as loss.

Of course, you’ll need to minus any overnight financing fees to get the net outcome from your trade.

If you have more questions visit the FAQ section or start a chat with our support.